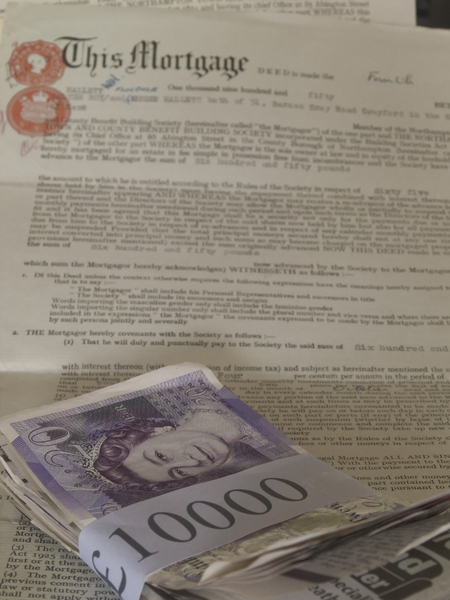

Getting obvious, a home collateral financing (HEL) is a type of next financial. Due to the fact https://paydayloansconnecticut.com/saugatuck/ several voice equivalent, there are subdued distinctions that make all these selection book. If you find yourself a beneficial HELOC work a lot like a credit expansion, enabling consumers to use as often otherwise only a small amount of their own security, family collateral finance give an individual lump sum of cash upfront.

Which have a house equity loan, the lending company offers borrowers with financing according to an effective part of guarantee within the a respective asset. Hardly will loan providers allow property owners in order to borrow on most of the guarantee within their property. For this reason, traders that have $one hundred,one hundred thousand inside guarantee within rental assets is able to use a share of money he’s got during the equity, doing no matter what bank deems acceptable for their unique condition. Given that home equity funds are, in fact, a one-go out lump sum payment, their interest cost is actually repaired.

[ Curious how exactly to fund the first financing price? Click here to register for the Free online real estate category where you can learn how to start-off into the real estate paying, even with limited finance. ]

Taking right out the next home loan toward money spent assets has actually offered buyers because an excellent alternative source of money. In the event the, to own hardly anything else, the greater number of indicates an investor is able to secure financing, a lot more likely he or she is to safe an impending price. But not, it needs to be noted you to a second home loan towards the local rental assets possessions actually rather than a number of extreme caveats. Such as for instance almost every strategy used in the real house spending surroundings, you must consider the advantages and you will cons of 2nd mortgages. Only when an investor is definite the advantages provide more benefits than the latest disadvantages if they consider using an additional financial on money spent property. Check out of the very well-known pros and cons off taking out second mortgage loans towards leasing services to help you function their thoughts.

In fact, there are two main number one type of next mortgages: family equity financing and you can house security personal lines of credit (HELOC)

Another home loan lets residents to help you tap into or even stagnant, non-creating domestic equity and put their funds to be hired for them.

Second mortgages make it home owners to find subsequent financial support qualities. Also referred to as a moment mortgage money spent, a good investment purchased that have an extra financial can perform returning alot more winnings than just bare equity.

2nd mortgages are safeguarded by resource they are taken out up against. Ergo, any skipped payments otherwise inability to get to know mortgage financial obligation you are going to effect from the loss of the first investment (your house familiar with obtain guarantee facing).

Put poorly and in place of an intend to build a revenue, 2nd mortgages are simply another way to change collateral for the loans.

Turning Your next Home loan Into the Funds

2nd mortgage loans may serve as a beneficial supply of capital. New guarantee one has in their house is an excellent origin to help you make use of, but We digress. Utilising the equity on your own number one house actually risk-free. Once i already alluded so you can, an extra mortgage use the original asset (your property) as the collateral. When your debtor out of another home loan can’t stay most recent with the its payments, the lender may go shortly after their home. Second mortgage loans have to be drawn really undoubtedly; do not bring that aside into the superficial acquisition of thing possessions. The new effects one to coincide having later or overlooked payments are way too major in order to risk for example a minor buy. That said, next mortgages can also be represent a window of opportunity for the individuals seeking make money. While pretty sure you are able to leverage a moment financial for the an possible opportunity to benefit, it could be sensible.