Check your application’s mobile look at deposit instructions to ensure you’lso are composing the correct statement ahead of proceeding. You could potentially hook your qualified checking or bank account to help you a keen account you may have in the some other lender. To suit your shelter, retain the unique look for at the very least five days Once choosing confirmation that it has been accepted. After you’re also willing to discard it, draw it “VOID” and you can throw away it in a fashion that inhibits they of getting displayed for payment once again.

Digital Wallets render benefits by permitting one to use your mobile phone and other digital gadgets to pay for one thing unlike dollars otherwise the plastic material bank card. Sure, it’s safe to expend utilizing your cellular, taking that you are to experience during the an authorized and you can controlled on the web casino. All of our demanded Spend From the Mobile phone casinos utilize the newest SSL security app and you may authentication have, so that you features overall peace of mind.

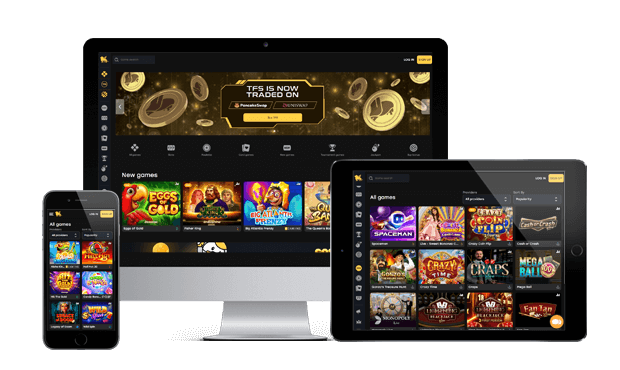

Different options to expend making use of your mobile phone – more hearts slot review

The methods for deposit a check may vary a bit, with regards to the standard bank. You can find put constraints, and they believe the new put method. No, that you do not spend a charge more hearts slot review after you create in initial deposit to your your Investment One consumer checking or savings account. The origination, maintenance, choices, and you may product sales information are offered within the English merely.

- The rest $dos,275 might possibly be available on Wednesday (2 Business days following recognition).

- We along with be sure this site features an encoded SSL relationship, and therefore protects any personal stats which you post for the gambling establishment.

- Cora can help with a wide range of inquiries and feature you how to do the banking.

- That it visibility will give at least $100 of exposure if you affect overdraw your checking.

What exactly is mobile take a look at put that is it safer?

However, that it payment cannot influence every piece of information we upload, or perhaps the recommendations you come across on this website. We do not are the world from organizations or financial also provides which is often out there. Particular checks usually takes lengthened to help you process, therefore we might need to hold certain otherwise the deposit to have a small lengthened.

Pay by the cellular telephone/cellular financial is a technologies on the billions of people global instead access to banking companies or on the web financial. While the phones and you will cellular systems are very common, they supply a alternative to banking functions. Now that you have a better knowledge of simple tips to deposit a check on the web, you’re ready to begin. Which have mobile dumps, you could potentially put inspections on the web if it’s smoother for you. Before depositing a in the an atm, make sure you check if the brand new Atm is in your lender’s network.

Create your Automatic teller machine Put Password on the internet (only available to own company accounts)

Mobile consider put try a cellular financial equipment that allows you to help you deposit inspections on the checking account with your mobile device. Cellular look at deposit can make adding currency on the family savings simple and fast, without paying a trip to a branch. Mobile deposits are thought as the safe and secure while the any bank-accepted type placing a check. The newest Pursue Mobile application, for example, never ever areas passwords otherwise visualize study on your device while using Pursue QuickDeposit℠. Concurrently, cellular deposits to FDIC-covered accounts is actually safe exactly like all other deposit. If not, you can examine your account contract otherwise speak to your lender so you can find out about constraints to have mobile cheque put.

Look at Present Pro Analysis

Learn regarding the getting your Va work for payments due to head put. If you wear’t currently have a bank account, the new Pros Professionals Banking System (VBBP) can also be hook you with a financial that may assist you to set up a free account. For individuals who already have you to, find out tips improve your head put suggestions. Understand that extent you could deposit thru mobile cheque, the sorts of cheques acknowledged as well as your fund access which have cellular cheque put can vary out of business in order to organization.

1Mobile Take a look at Places is susceptible to confirmation and not available for instant withdrawal. David Gregory is an editor with more than ten years from expertise in the newest economic functions industry. Ahead of one to, he did as the a young child and members of the family specialist up to he generated the decision to flow abroad for many years to function and you will take a trip. All the dumps at this Investment You to definitely financial establishment try FDIC-covered so you can at least $250,100000 for each depositor, for every possession class. For more information about how exactly long it takes for money to move in and you will from your own membership, kindly visit the money access webpage. Just after both sides is actually seized, you could potentially select the right account to get the newest put … up coming enter the count.

Spend by the cellular phone costs is actually a secure and you will easier way to financing your casino membership. Within minutes, you’ll provides money deposited without the need to show any of your banking or bank card guidance for the local casino. For many who’lso are having fun with a pay because of the cellular phone statement gambling establishment, then you need to deposit and gamble in the exact same tool.

When the you will find one issues with the new cheque you have paid-in, we will contact you by using the newest postal target you’ve provided you. You should check the fresh target we keep for your requirements on the Profile part of their app. The first line of your own target try found in the Do my personal stats.