Are you willing to score a home guarantee personal line of credit that have an enthusiastic fha financing? Small answer:

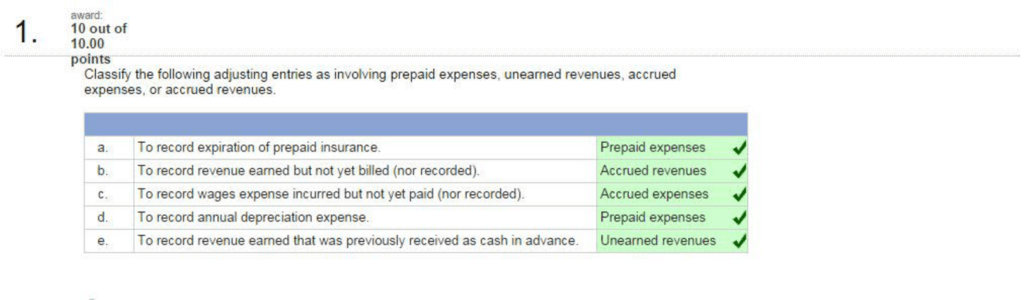

A house security credit line try installment loans no credit check no teletrack another home loan note predicated on equity of your house. These are not available from the Government Houses Administration, you could get a beneficial HELOC when you have an.

FHA is actually a myself had site, isnt an authorities institution, and won’t generate fund. FHA are a directly possessed site, isnt a government service, and will not create finance. Our home collateral mortgage enables you, since a homeowner, to help you borrow funds with all the security on your domestic because the collateral.

A home collateral personal line of credit is actually another financial notice considering security of your home. Speaking of unavailable through the Federal Homes Government, but you can receive an effective HELOC when you have a keen FHA loan and create adequate guarantee in the house so you’re able to be considered.

When you have a significant amount of equity in your home, both due to the fact you’ve paid off your own mortgage or since the sector worth of your residence has increased considerably over the equilibrium you are obligated to pay towards the property, you’re able to see a large financing.

Speaking of not available through the Federal Housing Management, you could receive a great HELOC if you have a keen FHA loan and build adequate security in the house so you’re able to meet the requirements. An effective HELOC are a good revolving personal line of credit getting property owners so you’re able to availability to the financing range maximum as needed.

Simply how much family equity loan can i get FHA?

You can borrow around 80% of latest worth of your house. Including, if for example the home is really worth $300,one hundred thousand, the utmost might be $240,100. After you’ve paid down your existing financial, you may then receive the remaining currency because the a lump sum.

Can you end up being refused a home guarantee credit line?

Your own HELOC is secure from the collateral you’ve got on your family, whenever you don’t have sufficient equity, you will end up refused. You will probably you would like at least 20% collateral of your house before you could would-be acknowledged for a good mortgage of any matter.

What sort of credit history would you like to get an effective HELOC?

Your credit rating is among the important aspects lenders imagine when deciding for many who be eligible for property collateral loan or HELOC. An effective FICO Score? of at least 680 is usually expected to be eligible for an excellent family guarantee mortgage or HELOC.

What exactly is FHA equity finance?

The house equity mortgage permits you, because the a citizen, to help you borrow funds when using the equity on your own home just like the equity. The financial institution advances the full amount of into financing so you’re able to the borrower, and is paid off which have a fixed interest rate over the expression of your loan.

Do you remove more income to your a good FHA mortgage?

Can Good HOMEBUYER Gain benefit from the Benefits of An enthusiastic FHA Mortgage Towards the A great “FIXER Upper?” Surely. A course also known as HUD 203(k) allows certified consumers pick fixer-uppers which have FHA secured financing, as well as has built-from inside the safeguards to the borrower should the resolve and you may repair procedure be more expensive than simply requested.

Just what disqualifies you from providing a home equity loan?

A debt-to-income proportion lower than fifty% Lenders need one to has actually a debt-to-income ratio out of 43% so you’re able to 50% at the most, though some will demand this to-be actually lower.

Would it be very easy to become approved getting an effective HELOC?

Direct credit score standards are different by lender, you fundamentally you would like a score on middle-to-high 600s in order to be eligible for property security loan or HELOC. A premier get (thought 760 or a lot more than) generally speaking makes for the most basic degree processes and gives your accessibility to your lower interest rates.