An enthusiastic FHA Loan is backed by the fresh new Government Property Management and you may nearly one in 5 homebuyers keeps an FHA Mortgage due to their home. Which financing are to begin with intended to help first time household-customers however, you can use it because of the people qualified. It’s an effective low down-fee replacement other mortgage loans. Generally, the fresh new FHA commonly straight back your during the trying to get the loan which brings https://paydayloanalabama.com/bucks/ up their dependability and you may enables you to look like a reduced amount of a chance given their low down-commission. In return, an enthusiastic FHA mortgage requires costs for 2 style of financial insurance policies: Upfront Home loan Cost (UFMIP) and you may Annual Financial Top. The new UFMIP was 1.75% of the total loan amount and can be distributed beforehand within the a singular payment, otherwise funded inside loan. Your own Yearly MIP can vary anywhere between .45%-step one.05% of the full home loan count considering mortgage size and matter in fact it is repaid month-to-month.

An FHA Mortgage is an excellent selection for a lowered off-payment. When you are 20% are an over-all presumption of the we for a down payment, dependent on your credit score you can go much lower than that. FHA enables a minimum advance payment from step three.5% with a credit history regarding 580+, that’s a lot of people. not, if for example the credit rating is lower than just 620, you’re at the mercy of extra requirements.

You can also use financial gift suggestions with the settlement costs and you will advance payment. It means when your closing costs mean $ten,one hundred thousand, you may also deal with something special of $10,000 from somebody and make use of you to definitely towards your will cost you. Most money do not let this because this is not indicative out of month-to-month money.

Additionally there is even more leniency regarding the loans in order to income ratio (DTI.) There have been two sort of DTI; Front-Prevent and you will Back-Avoid. The Front-End proportion is limited solely so you can casing will set you back, when you are the back-Avoid proportion considers your loans, for example handmade cards, vehicles money, and you can student loans, compared to the the month-to-month money. In a few things, an enthusiastic FHA mortgage will allow you to hold a personal debt so you can money proportion out of 56% financial obligation 30 days.

Was an FHA Loan the most suitable choice for you?

An enthusiastic FHA Loan is not readily available for all domiciles. First, it is only readily available for one to four tool house. In case the assets you’re looking purchasing is more systems than simply four, you must make an application for a different type of financing. Next, which should be your primary quarters. You can not have fun with a keen FHA loan to have the second domestic otherwise money spent.

Financing constraints also are a cause of FHA loans. These types of constraints will vary because of the condition as well as by the condition. This means that you simply can’t borrow cash aside which is more than the borrowed funds maximum. The most recent loan limitations for almost all areas from the Upstate/Central New york area try:

- You to definitely Product House: $356,362

- Two-Tool Domestic: $456,275

- Three-Tool Home: $551,500

- Four-Product Family: $685,eight hundred

A keen FHA Mortgage is also much more strict into the safety and health requirements. Before you transfer to your property, there has to be simply no concerns from house examination eg forgotten railings away from stairwells, chipped painting, things torn-down or rotted, etc. All of these must be repaired and you will examined before relocating.

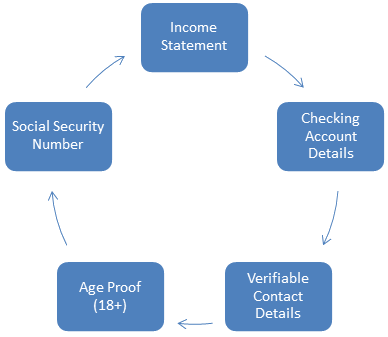

The only way to positively determine if you qualify for an FHA Financing is to try to talk to an authorized home loan manager. Might consider the following products:

- Your work record. Is-it secure? Just how long was your together with your earlier in the day and you can current employer?

- Your credit score and you can ability to pay your coordinated advance payment properly

- The home qualifications to possess an enthusiastic FHA loan

- The debt to income proportion

To find out more and to speak with that loan Administrator best today, phone call Premium Home loan Firm toll-totally free in the 1 (844) 793-0177. To discover the work environment nearest to you personally, check out the places webpage.

Corporate NMLS# 3254

Ny – Subscribed Home loan Banker NYSDFS License 3254 | Ohio – Mortgage broker Act Mortgage Banker Different – RM 8 – Kansas Office out of Financial institutions | Massachusetts – Lending company Licenses – ML3254 – Massachusetts Section of Financial institutions | Florida – Mortgage lender License – MLD745 – Fl Work environment regarding Economic Regulation | Connecticut – Home loan company License – ML-3254 – Connecticut Institution off Banking | Pennsylvania – Lending company License – 58841 – Pennsylvania Agency out of Financial and you will Ties | Vermont – Financial License – 6339 – North carolina Agencies regarding Economic Controls | Tx Service away from Discounts & Mortgage Financing | Tx SML Financial Banker Subscription | Nebraska – Nebraska Mortgage Banker Licenses NMLS# 3254 | Tennessee – Tennessee Agencies off Creditors NMLS# 3254 | Nj-new jersey – New jersey Home-based Mortgage lender Permit – Nj Institution off Banking and you will Insurance rates | Alabama Alabama Consumer credit Licenses #23190- Alabama State Financial Institution

1xbahis Güncel Adres » 1x Bet Mobil Casino

1xbahis Güncel Adres » 1x Bet Mobil Casino