House affordability features grown greatly within the last a couple of years that have domestic costs declining and rates of interest into financing losing on the reasonable. So if you’re planning to get property, then you would like to score normally regarding a mortgage that one can. If you’re a first and initial time home consumer, cracking our home financing qualification needs certain little bit of lookup.

Mortgage qualification try a button reference part for banking companies otherwise non-banking financial institutions (NBFCs) otherwise homes boat finance companies (HFC) to discover the limit amount borrowed a mortgage candidate was allowed to use and you will assess their/their honesty to pay back the loan.

On such basis as aspects instance credit history, label regarding financing, repayment skill, income, etc., the lenders would an in depth investigation of eligibility away from a mortgage candidate. not, for home loan individuals, it’s important to understand the a method to augment home loan qualification in fact it is how they can be own fantasy residential property.

Enhance your CIBIL or Credit score

A credit score usually boosts home loan eligibility. To accomplish this, you need to be certain the financing costs are built promptly. By paying bank card expenses and you may monthly instalments (EMIs) punctually, the seriousness when you look at the paying off loans have a tendency to think on your credit score. People default or impede adversely affects your credit score. Staying the lowest borrowing from the bank use proportion (CUR) will also help your credit score.

When you submit an application for a home loan, the lending company usually checks your credit score so you can dictate your creditworthiness. There are various borrowing from the bank bureau scores being utilized by finance companies and you can financial institutions. There is no lowest get for mortgage but 750 and you can over tends to be considered a good one to possess home loan acceptance. A good CIBIL score in addition to results in lower mortgage welfare given that really.

Choose for Mutual Home loans

In case you have numerous earning people about family relations, applying for mortgage brokers as you much more increases your chances to improve your property loan qualifications. Your best option is by using for home financing which have your lady and you will/otherwise moms and dads.

Co-borrowing not simply improves financial qualification and also splits installment load and provides taxation work for. A co-debtor with a good credit history increases their EMI cost, therefore improving your mortgage qualifications.

Choose for a lengthier Tenure

To improve home loan eligibility, you can go for an extended tenure financial. No matter if an extended tenure mortgage reduces the fresh EMI amount, they turns out increasing your complete appeal payable. So, you have got to cause of a top price of borrowing from the bank when you find yourself opting for an extended repayment period.

Clear The debt Responsibility

The debt-to-income ratio is a must with the credit associations to test the new financial eligibility away from home financing applicant. Thus, for an applicant, it makes sense to pay off all of the loan financial obligation that can absolutely feeling the girl/their home loan qualification. She/the guy will be boost credit history by paying pending debts.

Maintain your FOIR Lower than forty%

The brand new proportion of the bills to help you earnings is the Repaired Duty so you can Income Ratio (FOIR) and it is a serious factor to have deciding a person’s home loan qualification. Really monetary institutions’ financing activities assume that you would like next to 50% of one’s income to possess paying for the bills. Ideally whenever opting for a home loan, attempt to limit your FOIR to doing 40% to help you increase the odds of obtaining financing recognition.

Claim The Most Sources of Money

Your house financing eligibility grows when you claim your a lot more provide of income. Incorporating another income source instance leasing income, part-day organization, an such like. might help during the boosting your monetary health ergo you should create another source of income whilst facilitates protecting increased amount borrowed. Most earnings have a tendency to increase FOIR, ergo underlining your highest repayment skill.

You will need to Lay out a higher Down-payment

A lending institution or a loan provider cash a mortgage so you can just as much as 75% to help you ninety% of the property worthy of. Although not, you ount. Lower the down-payment, high will be your financing really worth, and this highest payable attract. It is therefore usually better to generate higher advance payment very regarding end large appeal payment.

Stop Occupations Transform

If you’re an effective salaried person and so are going to incorporate having home financing, then you is continuously work with an organization for two ages. Frequent business changes feeling home loan qualifications count. Thus, think should be made far ahead of time to tell you couple of years of persisted service in an organisation.

Choose the right Bank

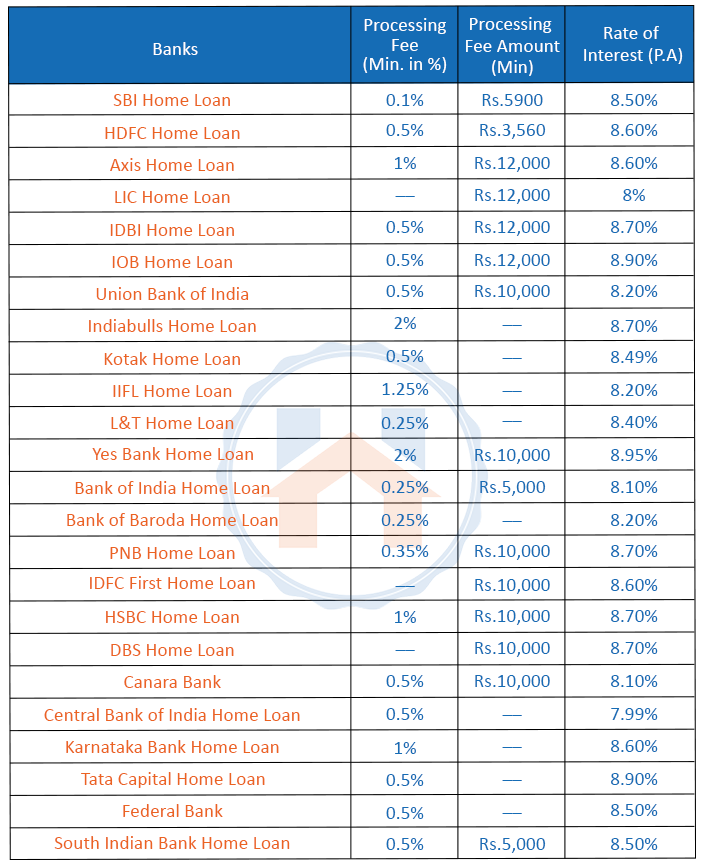

When you’re a new comer to borrowing from the bank or worry about-functioning you’ll encounter best odds of providing that loan regarding a casing finance company. Extremely construction financial institutions allow us into the-family models and help him or her determine installment skill and you will credit worthiness out-of individuals that have relaxed types of money.

HFCs allow us a distinct segment within section as well as options into the affordable lenders and therefore are sometimes a far greater wager. HFCs have exposure in small areas in which finance companies aren’t expose. Getting salaried people with a high credit rating the choices often be individual otherwise personal market finance companies. Always decide for lenders that have an effective parentage and you will tune record.

Likewise, loan providers usually envision 85% (loan-to-value) to have money. However if its a medication project because of the lender, or if they have a good relationship with the latest creator, they may be able consider around ninety% LTV.

Dont Worry or Rush

Its told not to stress or hurry during the making an application for a mortgage. You have to do best browse and give big date before you apply getting a mortgage. You really need to estimate your finances, determine your revenue otherwise earnings, look at your CIBIL report to own problems, evaluate loan solutions, select from repaired or floating interest rate and choose need interest levels that have lowest a lot more charges before applying getting a property loan.

Conclusion

By firmly taking the aforementioned-stated procedures to change and increase your odds of being qualified to own a home loan, you might swiftly become entitled to a top loan amount, offered tenure and higher small print. You really need to begin the process by first enhancing your credit ratings and you can repairing one mistakes if needed.

Creditworthiness is a vital grounds to get mortgage brokers. On the other hand, always lower your loans so you can earnings ratio and help save actively for your downpayment to find the home of the desires.

Recommendations given towards Forbes Mentor is for instructional aim only. Your financial situation is exclusive therefore the products we feedback may possibly not be suitable for your circumstances. We do not bring economic advice, advisory or brokerage services, nor do we highly recommend or advise individuals or even get or offer version of carries or securities. Abilities advice might have changed just like the time of publication. Earlier in the day results isnt a sign off coming efficiency.

Forbes Coach adheres to rigorous article integrity conditions. Towards the better of the degree, all-content are specific as of brand new date published, in the event has the benefit of contained herein may no offered be accessible. The latest views conveyed will be author’s by yourself and just have not been offered, accepted, otherwise supported from the our very own people.

Güvenilir Casino Empieza Bahis Platformu

Güvenilir Casino Empieza Bahis Platformu