7 Methods to Money Your Domestic

You happen to be excited to find your household, although economic considerations shall be daunting, specifically for basic-go out homebuyers. With the help of our tips since your publication, you could be waiting and you will pretty sure regarding domestic browse in order to finally closing.

As well as for men and women merely beginning to believe homeownership, begin by such financial do’s and you can don’ts to help you feel able when you decide when planning on taking the next thing.

step 1. Place a funds centered on your money.

The first step into the purchasing a property: Determine your financial budget. Wonder, simply how much house can i manage? Figuring your debt-to-money ratio is an important action to that end. Keep the percentage around 31% otherwise shorter.

Professional Tip: Use all of our financing calculators in order to get to know your money, get acquainted with a home loan terms and commence examining the to shop for stamina.

dos. Create your funds specialized which have pre-acceptance.

Pre-approval is even a great way to determine how far your can easily manage. You could potentially secure your lender or manage MTH Mortgage*, the most popular Meritage Belongings bank, who will help from this point until the date your personal. You can get a start to the getting pre-approved by MTH Mortgage by filling out their on the web app. It can want to know very first questions regarding your current casing disease and you will money.

An identical should be the circumstances if you are using other lender that will usually follow up having a whole credit history and character, which will help you decide on an educated mortgage selection for you.

step three. Make an application for the mortgage that works for you.

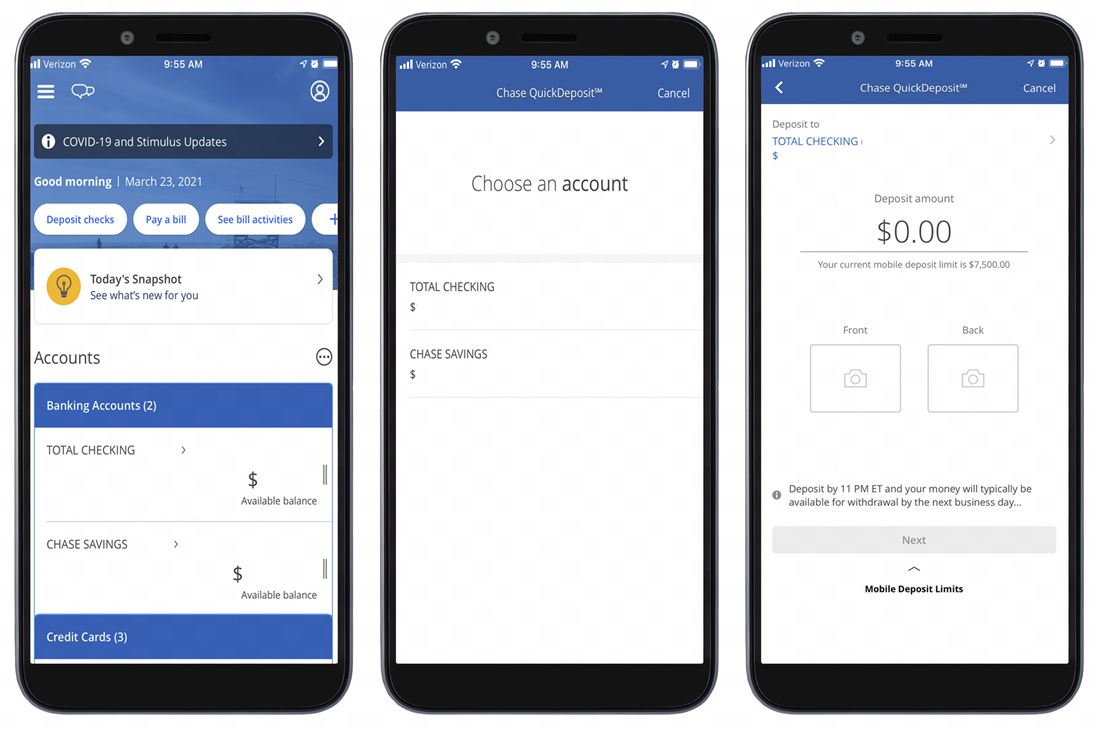

When you are pre-accepted and find your chosen Meritage home, the borrowed funds software process initiate. You’ll be necessary to display certain private and monetary suggestions because really since getting your credit file removed and you may viewed. Luckily for us, MTH Mortgage also provides homeowners a simplistic and you may streamlined road to money the place to find its desires by way of electronic home loan apps readily available 24/7 and you can an established relationship with Meritage Land. This way, someone could well be with you every step of one’s way.

Applying for a imperative hyperlink loan that have good co-debtor? Remember they are going to typically have to express a comparable depth and you will depth of individual and you can economic information as you. Don’t be concerned – when your mortgage manager try an expert, they will help you stay advised and offered regarding the techniques.

Here is a sample of one’s advice you will need to features towards the hands in software process (look at the complete list):

- Home background

- A position records

- Bank accounts

Expert Idea: More prepared and you may over you’ll be using this type of recommendations, the less pursue-up concerns will be required. Meaning a faster-swinging mortgage techniques and you can a quicker way to control. You should never eradicate vision of pleasing an element of the process: their brand-new home.

cuatro. Manage the loan processor.

Once you implement, your loan would-be allotted to a loan processor. Their job will be to aid you to construct a document making use of the files you’ll need to qualify for finally recognition and closing.

- Verification: All the information about your income, property and obligations within the 1st loan application would-be confirmed because of the spoken and you may/otherwise created verifications.

- Appraisal: Their mortgage company usually arrange for an authorized a residential property appraiser to help you substantiate the value of your home.

- Homeowner’s insurance rates: Thirty day period in advance of their closure date, choose an insurance service provider. While to buy an excellent Meritage domestic, the newest Meritage Homes Insurance company* works closely with MTH Mortgage to ensure the procedure happens efficiently. At the very least 10 months before closure, you will end up questioned to add proof your residence insurance; which need to exist just before closure.