Very auto name loan providers spend nothing attention to your credit rating when considering your application. That is because they supply shielded automotive loans which use your car or truck since collateral.

When you have an auto that is reduced (otherwise provides latest guarantee in loan) and you have verifiable work you to definitely will pay enough to pay for the monthly loan commission, then you’ll definitely be acknowledged to own a title loan.

Name loan providers forgive less than perfect credit histories as they features a good fallback choice in the event that you default in your mortgage. The financial institution normally repossess your car or truck any time you prevent and then make costs, since your car’s title obtains the borrowed funds.

A consumer loan – the type that does not require that you exposure your personal property getting acceptance – usually has www.clickcashadvance.com/loans/personal-loan-rates tight acceptance standards and requirements comprehensive borrowing from the bank inspections. That is because, should you decide prevent spending, the lender has nothing recourse apart from promoting the loan to a collection institution to have pennies for the money.

So you’re able to mitigate that risk, loan providers tend to scrutinize your payment records to get rid of delivering a massive losses into the that loan. But when you standard on the an auto term loan, the lending company can take your car or truck, sell it, and you will recover really (and regularly much more) of your own currency borrowed for your requirements.

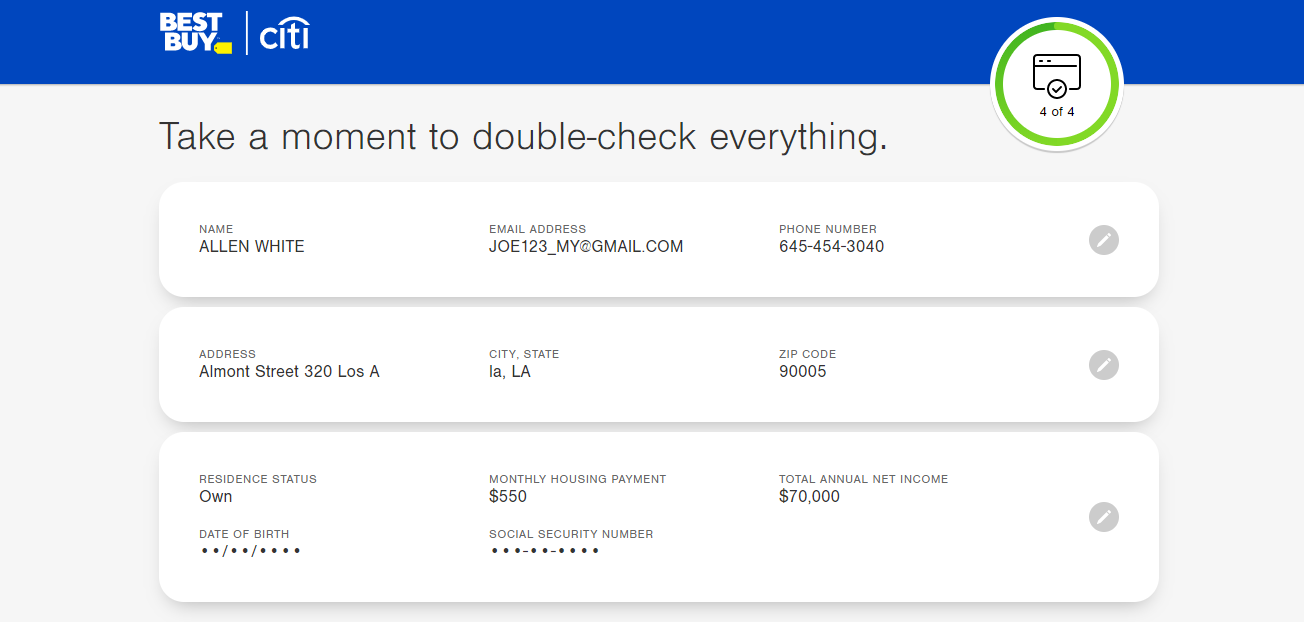

This is why many auto identity loan requests you should never include credit rating guidance. Alternatively, the financial institution have a tendency to request facts about the car, facts you have it downright, and you can research-of-money pointers that displays simply how much you will be making, along with your current invoice obligations, to decide your debt-to-earnings ratio.

As bank identifies as much as possible pay the financing, he could be browsing thing their money easily and up coming put a lien on your own automobile providing you with the new credit agencies accessibility they in the event the costs commonly generated.

Simply how much Could you Get for a title Loan?

Lenders design extremely automobile label money having users that have a good less than perfect credit record. This type of finance have a tendency to function enormously large interest rates and you will brief fees words.

Lenders need to make money. The only method they are doing that’s of the reducing its chance and improving their attention choice. Just like the too many of those financing end up in default, the only method loan providers can be make sure some sort of money is if it lend you considerably less overall than simply your vehicle is definitely worth.

Next, for people who avoid making payments therefore the bank seizes your car or truck, brand new agencies are available they and you may recoup their brand-new loan money along with the exact same money it can are entitled to through your interest. Often, they generate a great deal more thanks to attempting to sell your car than for individuals who meet the loan personal debt due to monthly payments.

Exactly how much you earn for the loan is dependent on your lender’s loan-to-really worth ratio standards. Each bank kits a cap exactly how much it loan – which normally translates to a percentage of automobile’s newest worth.

Extremely loan providers usually give out fifty% so you can 85% of automobile’s Bluish Book worthy of. Particular lenders, no matter if uncommon, goes as low as 20% so when high while the 120%. Couples loan providers promote their financing-to-worth ratio criteria, very you will have to speak to your financial – before you apply – discover an idea of how much you may want to qualify for.

Understand that some loan providers together with tack to the origination charges, set-upwards charge, and other put-ons towards mortgage which can pull away from the commission. This is exactly at the top of extremely high rates that produce this type of money extremely high priced.

Your lender is to reveal every charges you’ll be able to happen before you can indication for a loan. However,, to take new safer front, it’s a good idea to inquire about before you could conclude one deal.

Can there be a credit check having Identity Finance?

All of the financial establishes different requirements to have allowed whenever reviewing financing app. While some loan providers always wanted a credit assessment and you will earnings verification for acceptance, of many vehicles title loan providers leave a credit check and simply ask to have proof money and you will more information about your automobile.

Borrowing from the bank doesn’t matter normally to your bank because they can profit from the borrowed funds if or not you have to pay they or otherwise not. That’s because it obtain about attention put in each commission – otherwise they make money from promoting the car if they repossess they in the case of a standard.

But for the handiness of a no-credit-evaluate loan, you can easily pay rates of interest you to climb up as high as 25% monthly (hence equates to more 300% annually). You will almost certainly deal with financing place-right up charges or other stipulations that may look strange for you.