What you need to Discover

- Structure fund front your dollars to build a separate domestic (or even remodel property)

- Certain design loans convert to regular mortgages because property is depending

- Down payments and you will interest levels usually are higher than he or she is having conventional mortgage loans

Content

House search are one another thrilling and you can tiring you might be all the swept up thinking about other people’s translation out-of an excellent fantasy home.

If you find yourself there is certainly this package possessions which will tick all of the their packets, it is far from a hope. So, imagine if you’d the opportunity to make your own dream household?

A housing loan will get you the amount of money you’ll need to create your tailored-to-your dream household otherwise renovate your current digs.

What is a houses Loan?

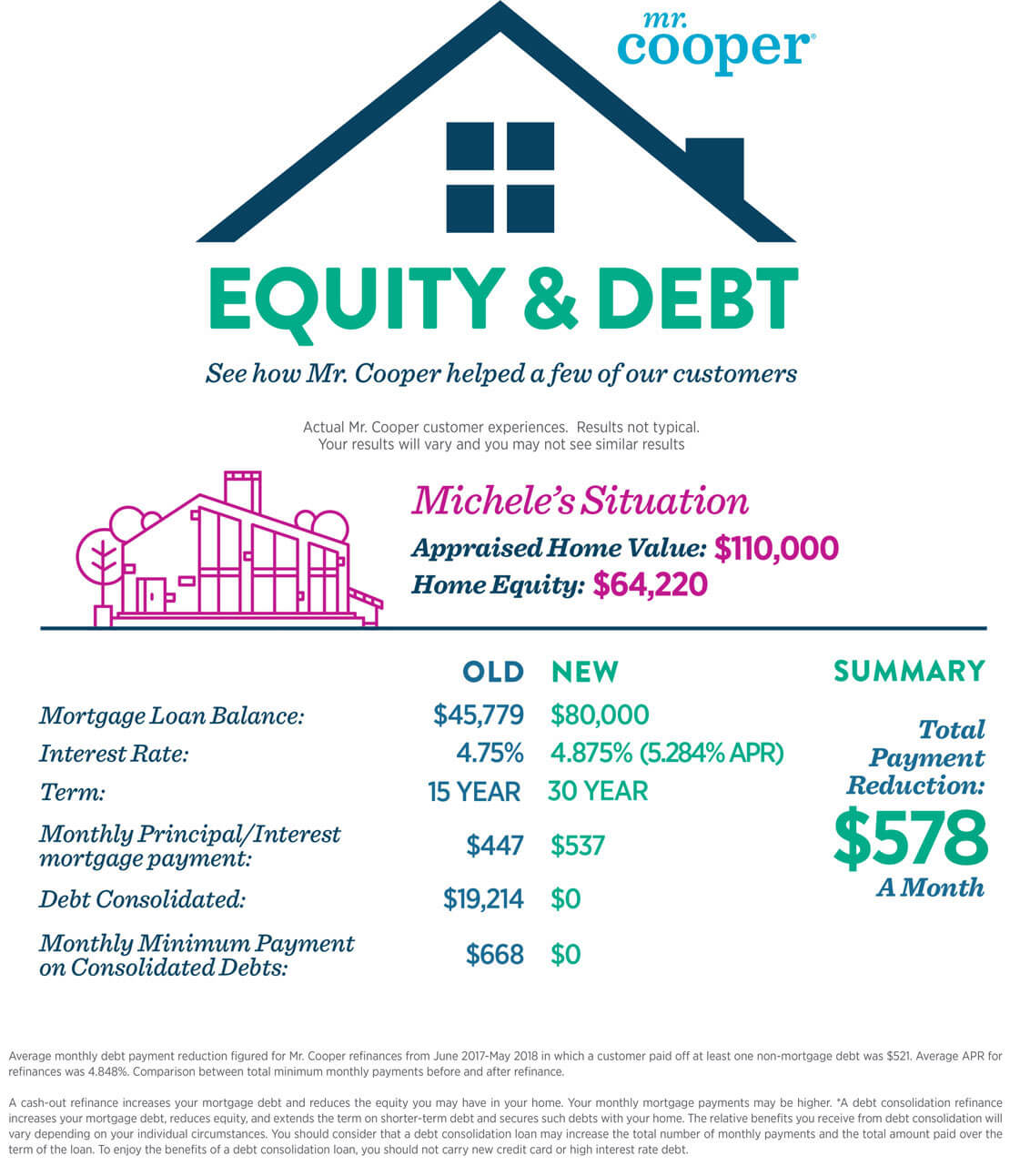

Build loans is actually short-title funds that can help your coverage the expenses to build an effective new house. These types of financing constantly hold a top interest rate than just a long-term home loan, that will be given that financial features significantly more risk to take.

The development mortgage pays call at installment payments, and these installment payments have been called pulls. There is certainly a draw anytime this new designers come to additional construction milestones. New inspector monitors this new advances and you can okays the newest costs.

For every single construction loan investment choice is some other, you could usually anticipate to make your first appeal-just fee on the mortgage six a couple of years following the financial helps make the earliest mark (otherwise percentage) toward builder.

If you wish to reduce desire, while making money on the borrowed funds just before the first due date usually help you save serious cash eventually!

How much does a casing Mortgage Protection?

A houses financing was designed to defense the expense of building a property on the crushed up. It talks about every aspect of the create, therefore the residence is willing to receive both you and any furniture at the time you have made the fresh certification from completion same day payday loans in Lordship.

Normal expenses covered by a casing financing include will set you back physically related toward build. They have been brand new home get, closing costs, labor and strengthening materials, as well as the reduced apparent of them, for example agreements, permits and review charge.

At the top of build will set you back, you are able to the loan to fund permanent fittings, that may were kitchen appliances, sinks, bathtubs otherwise baths, as well as surroundings information, including fencing otherwise turf.

Various other urban area that can easily be protected by a construction financing is the eye set-aside. Permits your lender to advance the income to fund focus costs in your the harmony.

If the home repair Television shows keeps taught you things, it’s you to definitely structure isnt in place of threats or unexpected situations. Turns out people unexpected situations are not only in regards to our activity.

The fresh new unexpected situations may include things like overlooked fixes, an extra evaluation commission, point transform due to shortages and you may one transform for the plumbing, electricity and other options of your property.

The good news is that one can remain a number of the loan booked to have contingency supplies, which can be simply accustomed safety brand new unforeseen costs that frequently come up while strengthening a new household.

Structure loans can also be used to own family fix and recovery programs. If you are looking for a good fixer-higher or if you just want to boost the house you live inside the, talk to your design loan financial concerning the possibility of getting financing.

Just how a housing Mortgage Work

It’s important to know what you might be joining once you take-out a houses financing. Normally, framework financing rates of interest try varying, meaning it move up otherwise off plus the primary rates.

Güvenilir Casino Empieza Bahis Platformu

Güvenilir Casino Empieza Bahis Platformu