step three. Lower your Paying

When you beat spending, you might place additional money on loans and you can possibly actually cut cash on attention. Listed below are some a method to song the spending and decrease to the costs:

- Would a spending budget. List your monthly obligations, including book, tools and you will food, together with your expenses, particularly mastercard stability and you will student loans. Record exactly how much you have made each month, and you can deduct your debts and you may minimal needed financial obligation money. The quantity you really have remaining is a starting place in order to imagine just how much extra to place to your your debt rewards for each and every day.

- Set a goal. Knowing simply how much personal debt you really have and just how much you might pay on it per month, figure out how long it will require to repay the newest debt. Mark one to time on your own diary. Having a target planned could well keep you concentrated and passionate.

- Tune your own expenses. Have fun with any type of means works best for you, whether or not that’s an application, an effective spreadsheet, or a pen and you will paper. Write down everything you put money into, and you will feedback the newest journal all of the couple of weeks. This is an excellent way to finest know your own paying patterns and you will probably look for places that you could potentially scale back.

- Share with a pal or friend. When they discover you’re functioning towards a loans benefits purpose, your friends and relatives could possibly offer service. They could also make it easier to consider an https://paydayloanalabama.com/valley-grande/ effective way to funds otherwise fun things to do free of charge, all of that can help you stick to the objective while you are still living lifetime.

cuatro. Change to Dollars Just

While you are paying down debt, it may be beneficial to pay for something from inside the cash therefore you aren’t increasing your credit card stability. While you can utilize a card to suit your repayments, consider utilizing a debit card therefore you’re not borrowing from the bank money.

5. Consolidate or Import The Credit card debt

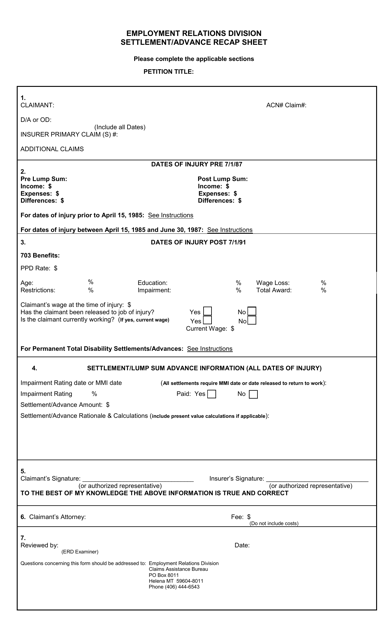

Another option for paying credit debt are debt consolidation otherwise merging several balances into the just one another one. Many people play with a credit card balance transfer otherwise a loans integration loan for this reason.

An equilibrium import mastercard promote lets you circulate outstanding debt from a single or even more account to a different charge card. These cards often have a reduced rate of interest getting good short time, that will help you save money if you’re approved. The pace usually develops following introduction period ends up. So it’s smart to make sure to pays off the balance inside the period frame.

Such as for example, let’s say you really have $5,one hundred thousand into the personal credit card debt therefore open a balance import credit card which have a great 0% introductory Apr. When your advertisements several months continues eighteen months, up coming you would have to pay from the $278 thirty days to settle the balance till the focus rate increases.

Also, it is a good idea to evaluate if the credit charges people charge and you may see the card’s fine print before you can incorporate to help you generate a fully advised choice.

An excessive amount of credit debt can potentially stand in just how from strengthening your financial wellness. Balances can build throughout the years, in addition they is adversely effect your credit score. And will apply to your capability so you’re able to qualify for the fresh new funds and you may handmade cards later on.

Even though it is demanding, settling personal credit card debt is possible if you install an obligations rewards bundle. Tracking the credit may also be helpful. And, once you initiate repaying the credit card balances, your credit score could even increase.

Güvenilir Casino Empieza Bahis Platformu

Güvenilir Casino Empieza Bahis Platformu