Alterra Mortgage brokers targets lending to help you underserved communities into the 34 says and Arizona, D.C. So it lender may help you rating a loan if you are a primary-go out homebuyer, is self-working, live in a household with several sourced elements of earnings, need help with a deposit, or lack a personal Coverage matter, otherwise require a spanish-speaking financing manager.

Article Versatility

Just like any of our mortgage lender ratings, the analysis isnt dependent on people partnerships otherwise advertising dating. To find out more throughout the our very own rating methods, view here.

Alterra Mortgage brokers Complete Review

Alterra Home loans is actually a mortgage lender that has been established in 2006 that will be now element of Views Home loan Classification. New Vegas-situated lender now offers a variety of mortgage things for most versions away from consumers, and folks who are care about-employed, need help with their downpayment, or features income out of several present.

While the a hundred% Hispanic-owned team, Alterra’s goal report claims it aims to assist underrepresented homeowner groups. The business says 73% of the people were diverse and you may 62% were first-time buyers during the 2019. Certain lender’s mortgage officers is actually fluent both in English and you will Language, which can only help multilingual users navigate this new homebuying procedure.

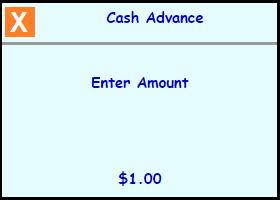

http://cashadvanceamerica.net/loans/buy-now-pay-later-sites

Alterra Mortgage brokers: Mortgage loan Versions and you will Products

Alterra Lenders also provides mortgages to possess individuals looking to purchase, upgrade, or re-finance a property. For the lender’s diet plan nowadays:

Alterra can also help individuals compliment of more homebuying difficulties, also. As an example, the business’s underwriting model accommodates consumers that happen to be self-employed otherwise who happen to live in households in which multiple family unit members lead into the monthly obligations.

The lending company also provides a different national mortgage program in which borrowers are able to use one taxpayer personality amount (ITIN) unlike a social Security amount. So you’re able to qualify, borrowers will have to provide a 20% deposit, show several years’ value of employment in the same variety of work, and offer their a couple of newest taxation statements utilizing the ITIN. This type of home loans come having increased interest rate.

Alterra Home loans: Transparency

Alterra Household Loans’ webpages does not encourage mortgage rates or lender charge and will be offering almost no facts about the choices. People wouldn’t come across factual statements about the sorts of money Alterra also offers, details about qualification conditions, otherwise of use info towards mortgage procedure.

Individuals is also fill in an online means so you’re able to request a phone telephone call off that loan officer otherwise they may be able head to among the latest lender’s inside-person part workplaces. I experimented with contacting the lender from time to time and didn’t connect with individuals, but we did receive a call-right back from that loan officer shortly after filling in the web means. The new user offered information regarding the borrowed funds process and you can given an effective price quotation in the place of a painful credit eliminate.

If you submit a mortgage software, you could fill out you to online or from the lender’s mobile application, Pronto In addition to. Financing manager have a tendency to get in touch with you to set up a free account and you will complete the mortgage approval process. You could potentially tune the job, publish files, signal documentation digitally, and make sure their work on line.

Alterra Lenders: Financial Prices and you may Fees

Alterra Mortgage brokers doesn’t encourage interest levels towards its site or promote a listing of charge borrowers you’ll spend within closing. Yet not, they ong very lenders. You may shell out on the 2% in order to 5% of the residence’s total price when you look at the charges, along with financial charges and and you will 3rd-people will cost you. Will cost you may include:

- Software and you may/otherwise origination commission commission

- Credit file fees (optional) prepaid will set you back

- Authorities taxation

- Tape charge

Mortgage qualifications from the Alterra varies with every mortgage program. To qualify for a conventional loan, consumers you want a credit rating of at least 620 and you can an effective minimum advance payment off step 3%. But with FHA money, borrowers you prefer a credit score out-of simply 580 which have a down payment with a minimum of step 3.5%. Alterra including needs a score of at least 580 to acquire good Virtual assistant loan, however won’t need a deposit.

Refinancing With Alterra Home loans

Homeowners which have a preexisting mortgage may be able to spend less or borrow money with a home mortgage refinance loan. Alterra’s site does not provide much details about the fresh re-finance process otherwise render information and you will interest rates, so you’ll want to contact financing manager for more information. Alterra even offers:

, that allow you to get a unique rate of interest, loan identity, otherwise each other. Residents commonly make use of this types of loan to save money, get rid of private mortgage insurance rates, otherwise option regarding a changeable-price mortgage to help you a fixed-rate financing. , which permit you to borrow money using your domestic equity once the equity. You’ll sign up for a home loan for over you borrowed from, repay your existing financing, after that accept the difference when you look at the cash.