The typical price of a marriage provides rising. The expense of wining and you will dining several parents as well as 2 kits regarding family relations can often be a primary expense. Add formalwear, bands, plants, prefers and you will a great rehearsal food and you can be looking within lots and lots of cash (or even more!). Certain lovers keeps savings capable put to use otherwise better-heeled mothers that are prepared to assist.

Relationships Finance: The basic principles

A married relationship financing are a consumer loan that is specifically made to fund marriage-relevant costs. If you’ve currently complete certain wedding ceremony planning you will know that there’s a big upwards-charge getting whatever comes with the word wedding connected to it. A knee-duration light beverage dress might cost $two hundred, however, a knee-duration white dress charged just like the wedding gowns? $800 or maybe more. An equivalent will is true of signature loans.

When you initiate shopping around for personal finance it is possible to observe that there are a few loan providers around, out-of traditional banking institutions so you can borrowing from the bank unions and you will peer-to-peer lending internet sites. Most of these features large-interest-rate products. But is it best if you accept these loans? Probably not.

The personal debt is a risk. The better the pace, the greater the danger. For folks who should have a marriage loan, it is essential to not simply shop for low interest rates. It is better to look for money with reduced or no fees, including no prepayment penalty.

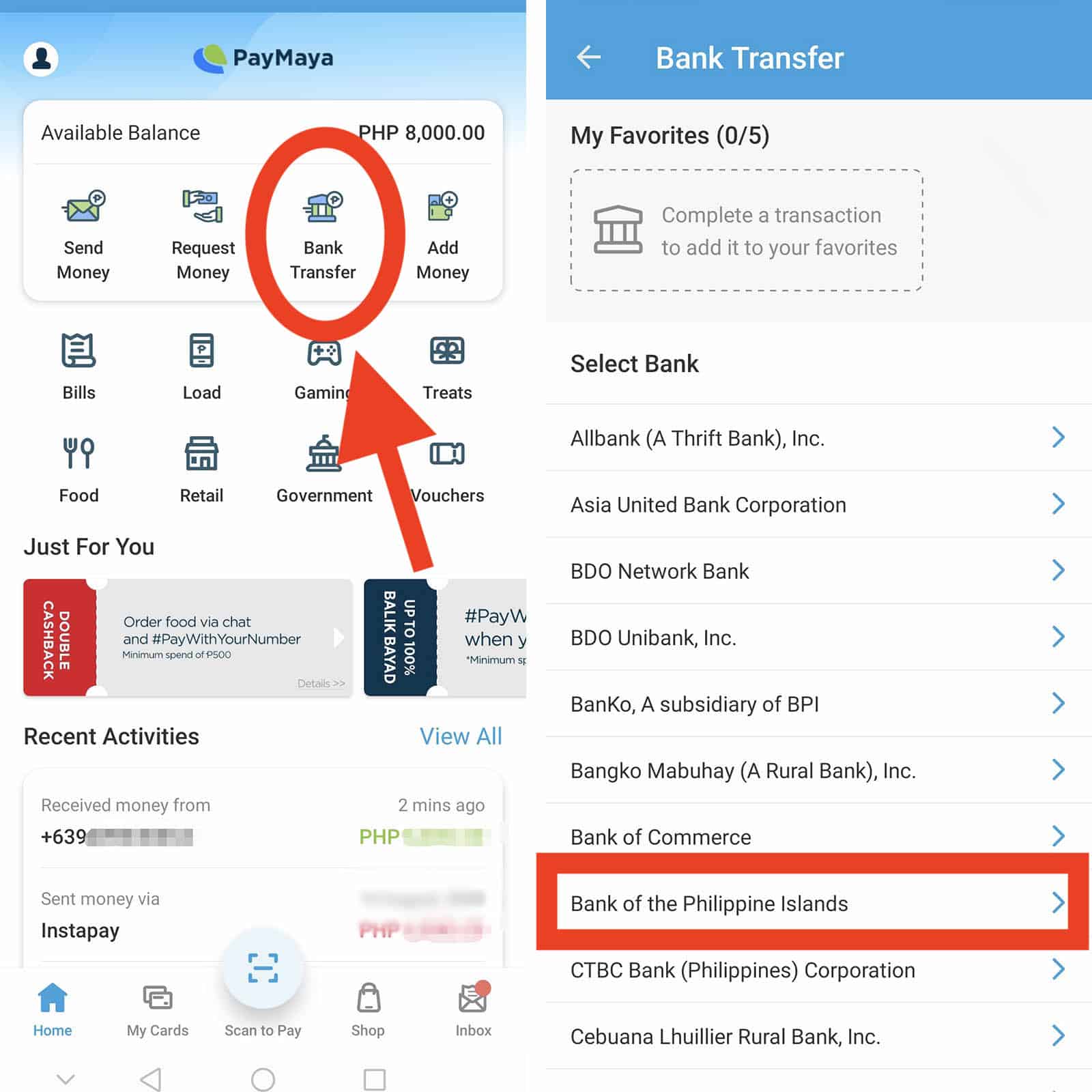

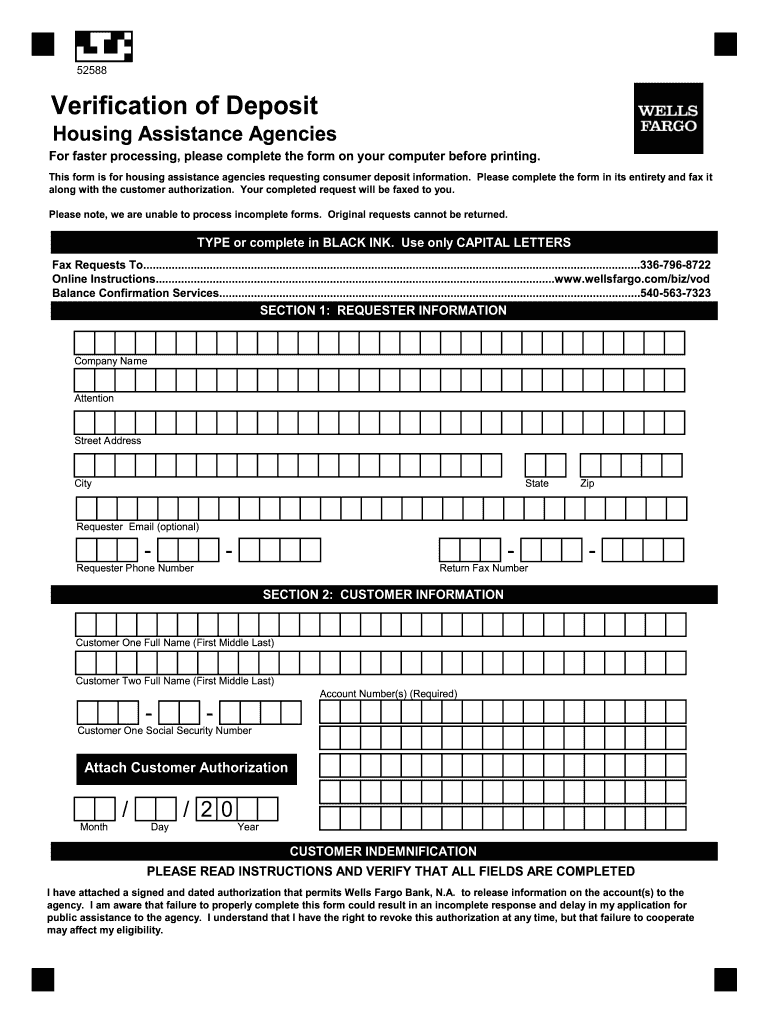

To apply for a marriage mortgage you’re going to have to yield to a credit assessment and glance at the normal loan underwriting processes, because you perform having a normal personal bank loan. The greater your credit, the low your own Apr (Annual percentage rate) might be. Your wedding day financing may also include a loan title. The new conditions usually are around 3 years many is actually while the long since 84 days.

Needless to say, people like to fees relationship sales on the handmade cards despite the fact that signature loans are apt to have lower interest levels than playing cards. Before you can place your marriage costs on the vinyl, it could be a good idea to explore consumer loan options. If you’re facing financial hardship or illness, you might be able to be eligible for a marriage grant you to will help you help make your wedding fantasies be realized.

Was Marriage Finance wise?

If you along with your designed along with her possess two strong, middle-to-higher revenues, paying back a wedding loan are simple. If your income is the fact high, then waiting and you will cut back to suit your marriage? Consider what else you can do to your currency you might spend on interest costs to have a wedding mortgage.

If you don’t have the type of revenue who would generate trying to repay a married relationship financing under control, investing that loan is actually financially harmful. The same thing goes having lovers one to currently hold significant amounts of personal debt. Got a home loan, car loans and you may/otherwise student education loans? In that case, it is best to think hard before you take toward much more debt.

Any sort of your situation, it is worth examining matrimony financial support choice that won’t leave you from inside the personal debt. Are you willing to provides an inferior, more modest matrimony? Do you decrease the marriage time provide yourselves more time to store right up? Nevertheless not convinced? Degree point out a correlation between high-costs wedding receptions and higher breakup cost. A small occasion could be the most sensible thing for the lender accounts as well as your matchmaking.

If you choose to pull out a marriage loan you can want to consider wedding insurance coverage. For most hundred bucks, a marriage insurance plan tend to refund you should your area goes bankrupt, a sickness waits your nuptials or the photographer loses any pictures. When you’re using the monetary chance of buying a marriage having financing, it could make sense to purchase oneself a small serenity out-of mind with a married relationship insurance policy.

It is advisable to look around to make certain you may be obtaining the finest purchases into both the mortgage while the insurance rules. Prices are very different generally. Knowing you’ve got sometime in advance of you will need to acquire the money, you could start taking care of thumping your credit score. Check your credit report to have errors, create to the-time costs and sustain their credit use ratio in the or less than 30%.

Bottom line

The audience is deluged having images out of pricey weddings inside our culture. It’s easy to take-in the content the simply relationship worthy of having is certainly one you to vacations the financial institution. You may want to envision remaining one thing small (or perhaps affordable). It’s likely that your wedding day is not the last large bills it is possible to deal with given that two. Think how can you pay money for a house pick, kids’ expenses and you can old age for individuals who get started the matrimony by using to the installment loans no credit check Columbus a huge chunk regarding debt.