Location is acceptable on for every Accused financial, in that each one of the Defendants can be found in, live-in, and/otherwise interact providers in this official section. As well, acts proscribed because of the Not the case Claims Operate had been the amount of time of the a minumum of one of your can you get a loan for cosmetic surgery own Defendants within this official region. Therefore, from inside the meaning of twenty eight U.S.C. 1391(c) and you may 29 You.S.C. 3732(a), location are right.

Relators has displayed the government that have punctual disclosures regarding the Untrue Claims Operate violations revealed herein as needed of the 29 You.S.C. 3730 (b)(2).

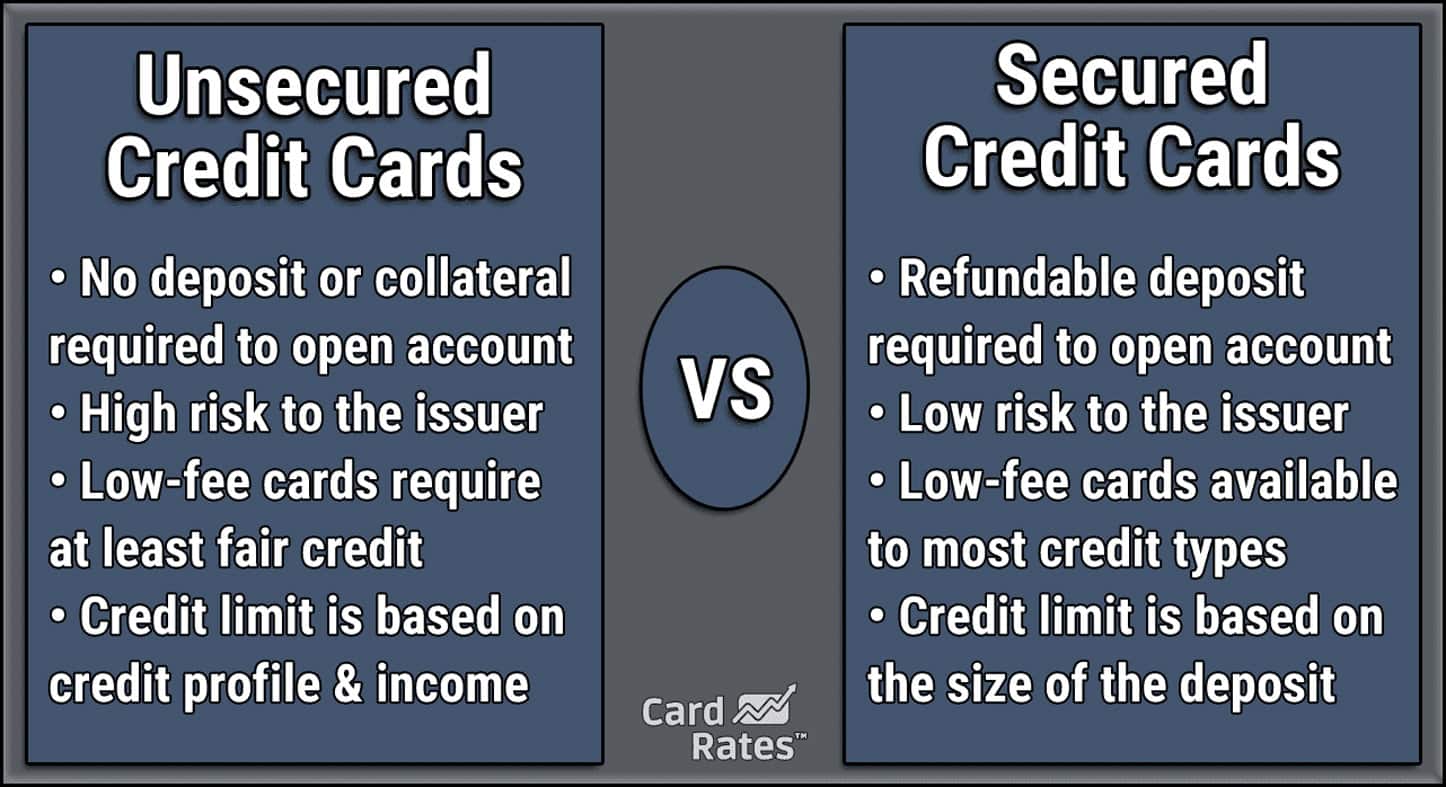

The newest Virtual assistant mortgage system pertains to good veteran’s benefit

29 U.S.C. 3729(a)(1)(A) brings one people who consciously presents otherwise causes getting made available to the usa people not the case or fake allege to own commission or approval is liable on the Us Bodies both to possess a municipal punishment as well as three times the amount of damages that your Bodies restores from the act of the individual. The modern civil punishment is not lower than $5,five-hundred rather than more $eleven,000 for every false allege produced. 20 C.F.Roentgen. 356.3.

31 U.S.C. 3729(a)(1)(B) brings one anybody exactly who knowingly renders, uses, or causes is produced or used, an untrue list or declaration point to help you a bogus otherwise fraudulent allege is likely into the United states Regulators both for a beneficial municipal penalty as well as three times the degree of injuries which the government sustains from the work of that person. The present day civil punishment is not lower than $5,five-hundred rather than over $eleven,000 for each not the case allege produced. 20 C.F.R. 356.step three.

The fresh new Incorrect States Operate represent a great claim to incorporate any consult or request produced through to a company out-of the united states to have fee of cash. 29 U.S.C. 3729(b)(2). Right down to the notification toward Va regarding non-payments out of IRRRL financing and that didn’t trigger property foreclosure, Offender lenders has actually was the cause of Authorities to blow reasonable figures hence in addition to amount to a allege. An untrue allege exists when the You runs into people cost or is requested to pay one count concerning the a good fraudulently triggered warranty.

No proof certain intention so you can defraud must establish a bogus Says Work citation. The newest conditions knowing and you will knowingly is defined in order to signify men (1) features real experience with what; (2) serves inside deliberate ignorance of one’s information or falsity of the infotherwisemation; otherwise (3) acts inside irresponsible ignore of one’s information or falsity of one’s suggestions. 31 You.S.C. 3729(b)(1).

IRRRL financing are supplied to help you retired or effective duty pros to help you re-finance residential property they already own. IRRRL money are available to the veterans just who now have a beneficial Va home loan. The application is designed to promote pros the chance to lower their latest rates otherwise shorten the new terms of present family mortgage loans. See 38 C.F.Roentgen. .

As financing are to own experts, and since brand new funds is to own down refinancing costs, and because the funds are guaranteed by the taxpayers, both method of and you may number of charge that can easily be implemented because of the loan providers try strictly minimal

The newest IRRRL promises obligate the usa Bodies to incur monetary expenses and you will shell out monetary states lenders shortly after standard, if the assuming a default happens.

Insuring that veterans aren’t strained that have too much charges is the one of your own number 1 seeks of the IRRRL fund. The official plan is direct, unambiguous, and published to loan providers:

Va rules changed inside the mission regarding helping the veteran to utilize his or her home loan work with. Hence, Virtual assistant statutes limit the charges the experienced can pay in order to receive that loan.