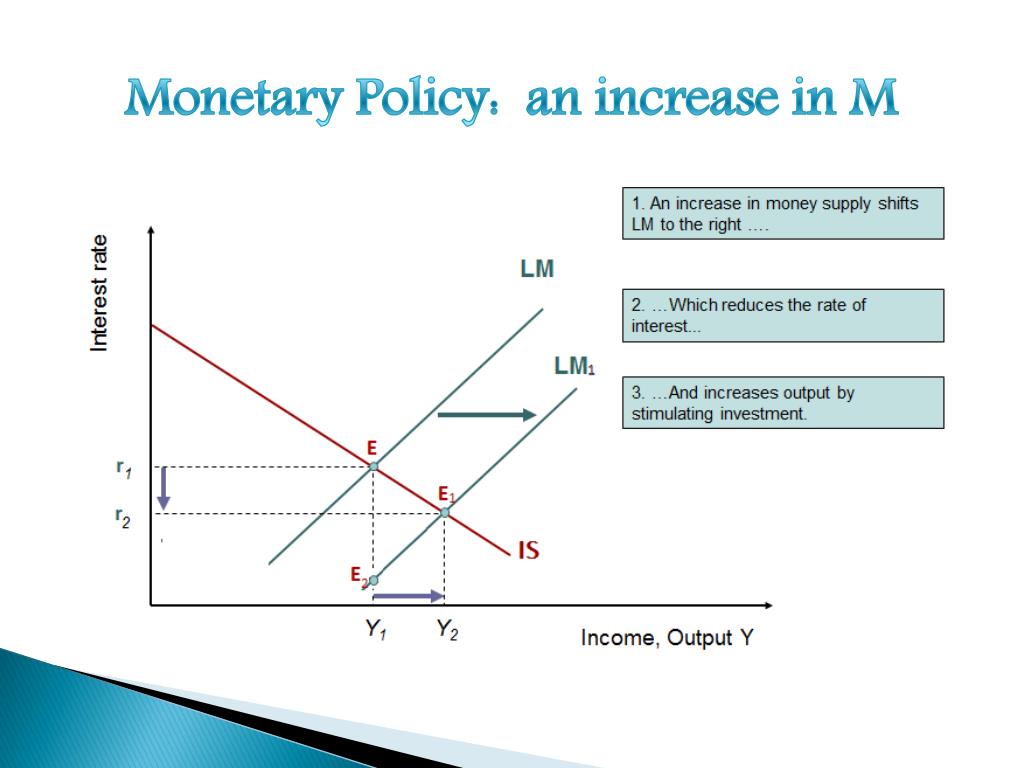

Rates payday loans Nathrop was basically trending downwards, for the Federal Set-aside using their earliest slashed away from 2024 inside the September. Analysts anticipate a whole lot more incisions you will go after regarding the latest weeks from this present year and you can to your 2025, possibly reshaping the real property business.

But all the way down rates usually do not usually mean ideal deals otherwise lower house rates. In fact, rates incisions may affect the latest housing marketplace during the alarming suggests. Certain experts predict inflation, but refuses and you can balance are probable less than specific factors.

We consulted community positives to break down for each opportunity. Its information lower than makes it possible to determine whether you can aquire property about upcoming days.

What the results are so you’re able to home values since rates of interest is cut?

“The most appropriate circumstances would be the fact home prices commonly increase in the event that price slices occurs amid economic development and you will limited homes likewise have,” states Albert Lord, originator and you will President from Lexerd Capital Management. That’s why the guy means buyers is to “operate easily to take advantage of straight down prices,” whenever you are “vendors get [should] wait to maximize also offers since request develops.”

Community experienced Dean Rathbun echoes it see. The borrowed funds financing administrator from the Joined Western Mortgage company points out one to rates incisions commonly lead to a sequence impulse.

“New greater the brand new clipped, the lower the newest costs… and thus far more individuals available, starting highest estimates to have wished land,” Rathbun claims.

Despite this opinion, this new construction market’s complexity setting some other scenarios you certainly will unfold. Listed here are around three it is possible to outcomes for home values regarding the wake of great interest rate slices.

step 1. Home prices often go up while the rates are reduce

When interest rates fall, the latest housing industry always gets hot . Cristal Clarke, luxury a residential property director on Berkshire Hathaway HomeServices, explains why: “Because down interest levels build borrowing more affordable, more customers enter the industry.” This constantly drives right up battle getting offered house.

But rates of interest going down is not the just factor affecting domestic costs . An effective benefit with an excellent employment market and you can rising earnings play a role, also. When such requirements fall into line that have reduced construction inventory, “consult can also be outpace also provide, leading to upward stress into home values,” Clarke states.

dos. Home prices commonly drop once the rates of interest is actually slash

Clarke warns that a significant depression may lead to price falls, even with rates cuts. It less frequent situation may appear when wide monetary items bypass the great benefits of inexpensive borrowing from the bank.

“[More] employment loss otherwise [low] individual confidence you are going to [give] customers [pause], [even with] lower rates,” Clarke explains. Enhance that highest rising prices deteriorating to buy stamina or stronger financing criteria, and you have a menu to possess possible speed decreases.

In these instances, a surplus regarding home in the industry and you will a lot fewer curious buyers could force sellers to reduce their asking rates.

3. Home prices will remain the same as rates try cut

In some instances, home values you will definitely stay set, though rates of interest miss. Predicated on Clarke, we could possibly look for steady home values whether your housing industry keeps an equilibrium anywhere between supply and request – whilst rates drop off.

She items to high-demand components and Santa Barbara and you can Montecito while the instances. These locations are always preferred “on account of [their] desirability together with increase out-of remote functions,” Clarke says. Restricted collection can prevent significant price movement into the certain area, eg seaside towns and cities.

Benefits of to acquire property now also at the large costs

“Whenever rates miss, buyers [flood the business] and costs have a tendency to go up,” cautions Rathbun. This will push upwards home prices, pushing you to overbid only to safe a property.

- Reduced competition: With less people home in the place of a bidding conflict.

- Possibility refinancing: If the pricing get rid of later on, you can refinance to reduce your monthly obligations.

- Strengthening collateral at some point: The sooner you purchase, the earlier you begin building money as a result of homeownership .

- Predictable costs: As opposed to book, your home loan repayments would not raise (with a predetermined-rates financial )

- Way more discussing strength: Manufacturers would be even more prepared to aid you when there was less customers as much as

The conclusion

The newest feeling interesting rate slices on the home values actually constantly predictable. If you’re straight down rates of interest could lead to high rates, economic climates will often end in price falls otherwise stability. In lieu of trying go out the market industry, manage your condition and you may long-title goals. If you find a property you adore and will spend the money for repayments, it will be best if you operate today .