To the minimal source of domiciles readily available, more individuals are planning on purchasing house and you can strengthening a domestic. I have had on 5 customers this current year alone mention trying to do this which is over all other many years mutual.

Strengthening should be good channel for the ideal people and you may condition, it boasts additional pressures. That you do not merely rating a typical mortgage and you can refer to it as a day.

Prior to I get engrossed, allow me to caution you to definitely just take this step sluggish. Too many some one decide they would like to accomplish that, they discover belongings, then they purchase it.

Before you can agree to that loan, in addition desire to be meeting with a builder to help you speed from house. The worst thing we want to happen is you choose the homes and the family costs way more than your consider and you feel caught.

This is certainly a massive, huge decision. Use the called for learning to make yes simple fact is that right choice and can work for you.

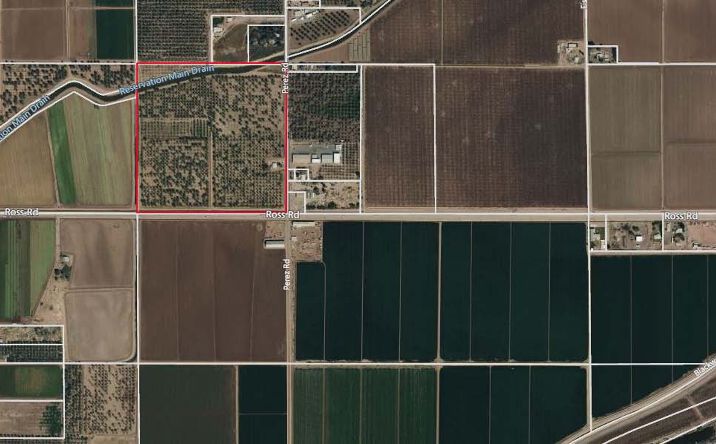

step 1. Lot otherwise Belongings Funds

Property funds was a variety of resource which you can use to acquire a parcel of land. They tend are harder so you’re able to qualify for acquire just like the there is absolutely no domestic used because the guarantee. They generally require you to set out a larger number (from around 20-50% down) as well as feature a high interest https://cashadvancecompass.com/payday-loans-ak/ rate since there was faster opposition inside place.

Should you get acknowledged, the financial institution will offer the amount of money towards seller and you usually pay back having attract more than a set period of time. Certain also are structured given that balloon mortgage loans, with focus-just if not zero costs getting a collection of date that have a big one time commission upcoming due a bit afterwards. You definitely need plan something like that because you will definitely want a lot of money otherwise an alternative financing for it to move on the.

2. Construction Loans

A homes mortgage are a temporary loan which covers the fresh price of purchasing the house and you can building a house. You use the amount of money to fund just about all of new land, for the build content.

Because the house is dependent, you may then transfer the building loan from inside the a home loan. With build financing, you certainly will you want at least 20% down.

Normally, a property fund have varying interest levels that can harm if you are strengthening through a time including the last couple of decades just like the price is evolving have a tendency to. In the event that lay has been centered, your commonly spend appeal simply with the financing.

But be cautious with this, your run the risk of great interest pricing becoming means large just after brand new generate is completed and you should get a mortgage.

A lot of people who built in for the past two years knows just how tough from a position this is exactly for people who end up their family and you may cost was a couple per cent high. For the majority, it has got was the cause of family becoming reasonable.

step three. Personal loans

If you’re not capable qualify otherwise see much mortgage otherwise build financing, particular had opted the station of a personal loan. I’d say this is exactly less common, however it is viewed as.

Unsecured loans are provided by the banks, credit unions, etc. and make use of these funds for very whatever you want. But they in addition to normally have large interest levels than mortgages. With a personal loan, he or she is unsecured, definition there are no equity requirements.

4. Land Contracts/Seller Investment

A substitute for the choices over would be to carry out an agreement to order the fresh homes directly from owner against having fun with a good lender. You simply generate repayments to the home until the mortgage try paid back. But not, you nonetheless still need to acquire resource for the strengthening of your own domestic.

You might generally speaking get more versatile words here because it is anywhere between you and the seller and never a bank. But it doesn’t always exercise while they might not want to have to manage wishing to the complete count.

Understand that these types of solutions hold exposure as you would not have the mortgage until the build is performed. I have seen so it put many people rating on their own from inside the good tough situation because they oriented centered on step three% pricing and now he or she is facing a eight%+ mortgage.

Please, delight, excite, spend time and map all this work our before you start the processes. Its never ever wise to hurry with the huge behavior.

Disclaimer: Nothing of this will likely be recognized as advice. This might be most of the having informative objectives. Speak to your judge, income tax , and you may financial group prior to making one changes into economic plan.