Homeownership is over simply a good lofty Western dream-its how many can be make generational money. Into Black colored society, 90% of riches progress are from homeownership, which means that owning a home is still an important means to possess Black property to construct and you will collect money.

Although the brand new il housing industry might have been aggressive, home buyers have been waiting towards the sidelines having costs becoming more affordable you are going to get a hold of specific relief soon. The brand new Federal Reserve (new Provided), new U.S.’ central bank that decides rates of interest, will continue to mean that a prospective speed slash is found on the fresh vista. Not only can that it impression affordability for potential consumers, however it might possibly be useful to possess current people that will be locked into highest rates of interest.

But, precisely what does all this imply? JPMorganChase answers a few of your questions because relates to potential homeowners and residents:

Mortgage loans respond to field conditions, such as the Fed’s monetary coverage. Due to the fact rates ascend, so carry out the focus towards the mortgage loans and you can mortgage payments. However, if the costs fall, very does the interest toward mortgage loans. Thus, to acquire from the a lower life expectancy rates could save you profit home loan repayments.

Time the market perfectly is not only challenging, but close impossible to would. While we vow the new Given will cut cost this year, it is never ever protected. All the way down interest levels will save you money, however, they’re not truly the only basis impacting value. Very, instead of centering on perfectly timing the business, we recommend leaning towards what you are able control: are economically ready to pick a home.

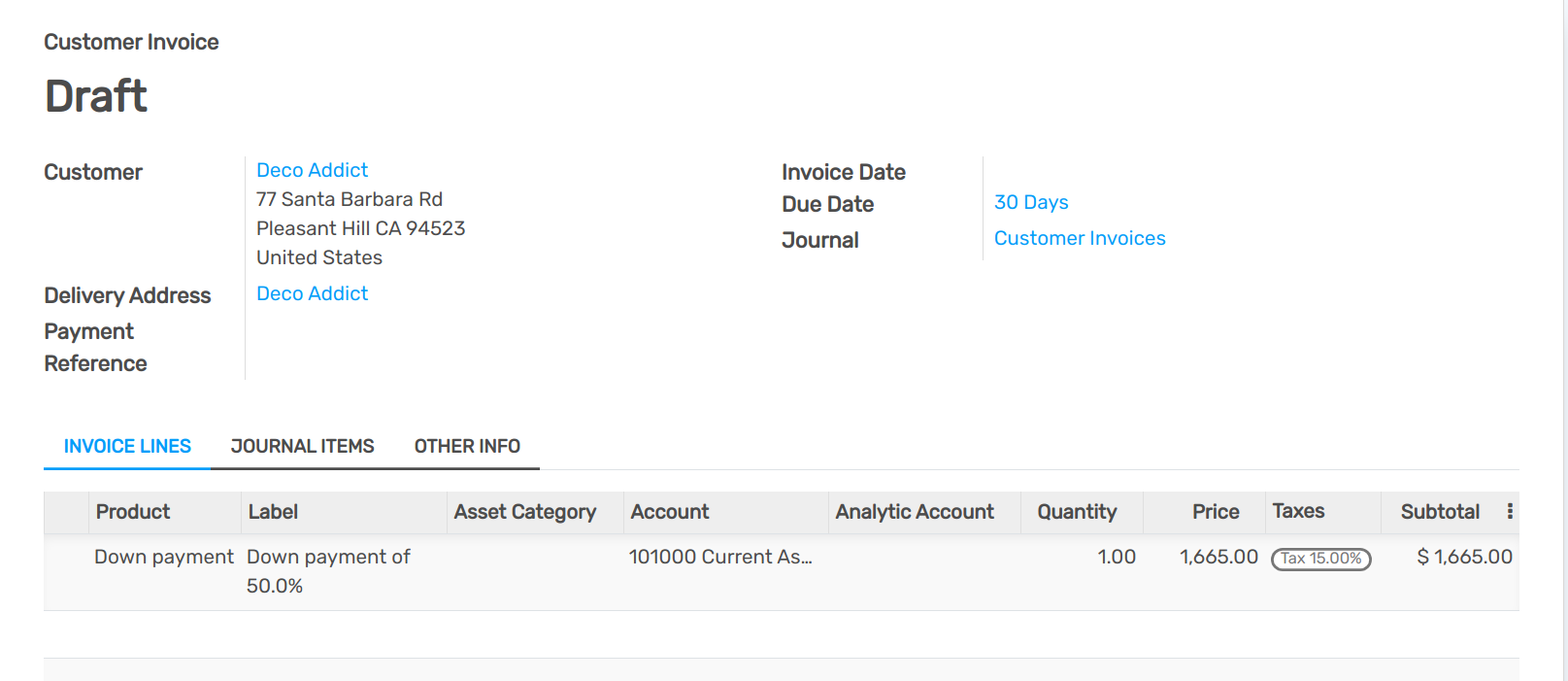

Outside readying your bank account to own homeownership, you can look getting selection which can keep costs down and promote savings such low-down fee mortgage loans, downpayment recommendations apps and you will gives. And remember you always can acquire a home today and refinance later on immediately after prices lose.

No matter if your repayments is actually highest, you may see tall coupons over the lifetime of the loan by making less attention costs

We not only need customers to reach homeownership however, so you can sustain they. This is exactly why it is critical to understand what exactly you can afford prior to getting toward markets. There are a selection regarding tips so you can get ready economically for buying a home to see just how much you really can afford throughout the components you’re looking to purchase, examine financing choices acquire a no cost credit rating.

Most earliest-big date home buyers try singularly concerned about protecting getting a lower payment. not, over certainly are the days of placing down 20% of your own purchase price low-down commission mortgage options are available with specific requiring since the reasonable given that 3% down. And additionally, there are various out-of bonuses and offers which can all the way down their will set you back https://paydayloanflorida.net/lake-helen/. For example, Chase even offers a homebuyer give as much as $eight,five hundred, where eligible, to support the interest rate, closing costs, while the down-payment. This type of provides appear in lowest- so you can reasonable- money groups and areas that will be designated because of the U.S. Census because most-Black colored, Latina and you may/otherwise Latino.

You will additionally have to start putting together all your valuable expected records for pre-approval, particularly W2s, financial comments, earnings records, an such like

Studies show you to definitely forty five% regarding consumers whom shopped around for mortgage loans acquired straight down has the benefit of. Generate loan providers compete for your business of many have differing charges and settlement costs that can seem sensible. Plus, interest levels can be vary each day, so lock in your own price along with your lender whenever they bring one selection for additional comfort.

It could be a lot of fun so you’re able to refinance when rates ‘re going off, specifically for people with cost significantly more than otherwise at seven%. To possess newest people looking to re-finance, we indicates these to continue its end goal at heart just like the it imagine whether refinancing is practical for their private problem. Focus on your local coach otherwise using a great Refinance Coupons Calculator understand when it is practical to suit your specific situation to help you re-finance.

When interest levels try down, you’re in a position to refinance the loan having a shorter label in the place of watching much of a modification of your own payment per month. Such as for example, you are able to intend to refinance a thirty-12 months mortgage on the an effective 15-12 months financing. Although it features higher monthly installments, it is possible to afford the financing down less and you may shell out less during the notice.

Whether we are going to see an increase reduce or otherwise not, there are various devices to possess basic-date homeowners and you can knowledgeable customers to save homeownership sensible and you will renewable. To find out more see Chase/afford to initiate the travels, put money into your following and conserve in the long run.

To possess educational/educational intentions just: Feedback and methods revealed may possibly not be right for men and women and aren’t suggested just like the specific information/testimonial for your personal. Information has been taken from present thought to be reputable, however, JPMorgan Chase & Co. or their associates and you can/or subsidiaries do not guarantee their completeness or accuracy.