When you find yourself applying for a home loan then chances are the financial institution will want to see your financial statements, however, exactly why are this type of related?

Getting working individuals the lender carry out anticipate to see a paycheck borrowing entry to the employer’s title said. This can next be mix-referenced along with other documents they could consult to help with your own mortgage application such payslips and you may P60s. To have worry about-working people the lender might possibly be finding normal credit hence recommend affordability of your mortgage try sustainable.

The financial institution report will even reveal while you are getting book of people functions your help. If you utilize a control institution the low net’ leasing shape might possibly be shown (i.age. when they enjoys deducted their costs), which may be the fresh shape the lending company use to determine if the house is thinking-investment.

The lending company will go from list of deals and look directly the bounced direct debits otherwise standing orders. Money for the (starting balance) compared to expenses (closure balance) to find out if your home is inside your form and tend to be on the condition to take on the added union out-of an effective home loan.

The lender will even evaluate when your social lifetime, travelling or holidaying is actually a lot more than average and you may whether or not you’ve got an excessively playing habit.

Extremely loan providers usually nonetheless provide for many who get into an enthusiastic agreed’ overdraft facility provided this is confirmed (very financial comments identify brand new overdraft number on them or even a letter on lender carry out suffice). Lenders will have deeper expertise should this be a regular knowledge including Xmas and you will will be less tolerant when it a great recurring element since it offers the perception you reside beyond your own form. In an enthusiastic overdraft will also have an effect on your own credit score rating (computerised point system built to rates your odds of paying borrowing) and that depending on the lender can lead to the home loan application are declined.

There are loan providers which do not provides a borrowing scoring’ rules preferring to allow an underwriter make up your mind as well as have several loan providers who would host you surpassing this new overdraft limitation. When you yourself have had experienced this type of difficulties a professional large financial company like Niche Suggestions should be able to assist you further.

The financial institution use the bank comments to see the fresh new magnitude of the obligations (for example signature loans, hire purchase, secured finance, handmade cards, credit cards etc) and measure the percentage make. Extremely common getting individuals to help you understate their debt condition for the home financing application only to be discovered away in the event that lender statements had been provided. Non-disclosure are frowned upon, and will resulted in financial application getting refuted, so it is ergo crucial your financial comments was seemed very carefully and you can credit obligations shown securely from the form.

What do mortgage brokers look for in your bank comments?

Figuratively speaking, repair repayments, childcare, studies charges, public memberships, rent, insurances, retirement contributions, assets services fees can all be placed bare and you may considered from the financial inside their cost research.

If there is an enormous deposit on your own membership (circa ?step 1,000 or more), and this refers to demonstrably unrelated on the work, then the lender sometimes one having a reason. As to the reasons? Better he has an obligation off care for the Currency Laundering Guidelines and therefore need be the cause of the new origination of All deposit proceeds accustomed purchase the possessions. An equivalent steps would apply it indeed there a series of less undeterminable credits.

The lender will generally look for utility bills, operating licences and at the fresh voters roll so you can facts where you real time, although not, the lending company declaration offer an alternate source of verification supply all of them even more morale.

This could be a segmet of papers that will produce rage. Lenders’ have become picky with the format of financial statements.

New dated fashioned’ report comments are normally liked by lenders while they can tell whether or not they could be the genuine article. Individuals can get not surprisingly provides a resistance to part with brand-new documents but the financial can come back these types of due to the fact home loan techniques might have been accomplished.

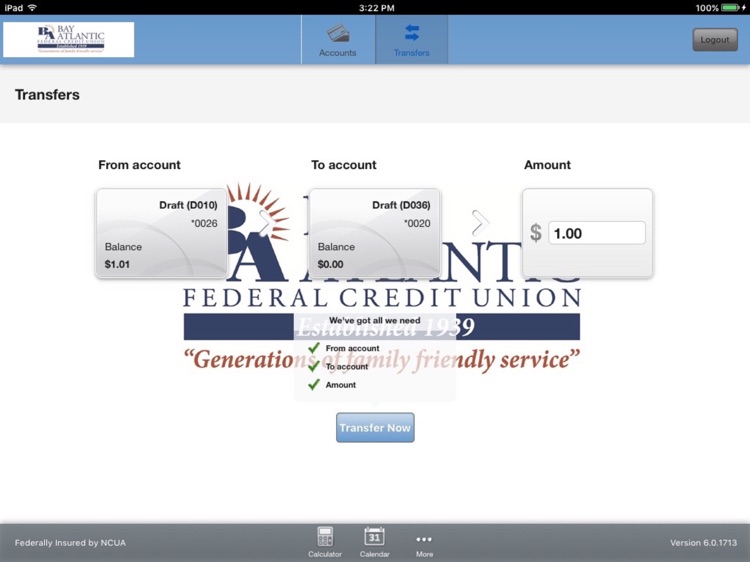

Many Loan providers try however banking companies by themselves and you can take pleasure in you to definitely times has moved loans in Mill Plain on so you can an online paperless business, and thus might deal with statements introduced straight from your bank’s website considering he could be in the a recommended style. Here you will find the key style guidelines for the comments less than: