To the expected regular upsurge in demand for one another public and you will individual homes in the Singapore, the need for family home improvements does increase and you can looking for the optimal home loans, repair funds, otherwise personal loans to have domestic requests becomes crucial for cost-active and you may productive do-it-yourself.

Regardless if you are planning to to get a BTO/selling HDB apartment, condo, otherwise individual property, contrasting competitive interest levels, versatile fees conditions, and you can quick approval procedure is important. Here are a few expertise in order to select the distinctions anywhere between home loans, restoration funds, and private funds to possess do it yourself arrangements, and suggestions for deciding to make the proper possibilities.

Scope of good use

Since identity means, home recovery loans was purely useful for restoration-relevant costs. This consists of structural work particularly floor, electronic functions, color, and you may built-into the cabinetry however, does not stretch to help you low-architectural or ornamental elements. This can be in lieu of home loans which happen to be mostly for buying assets, within the price of to get a property but will not extend to almost any recovery or decoration will cost you that will be obtain immediately after pick.

Likewise, signature loans try very flexible with regards to use and certainly will be used to own sets from debt consolidation, medical expenses, travelling, otherwise house home improvements. Yet not, as opposed to a certain ree favourable conditions (particularly all the way down interest levels) to possess restoration aim.

Assets and you will collaterals

House home improvements funds are usually unsecured, definition it does not want a secured asset because security, when you find yourself home loans are usually protected against the assets getting purchased, and thus the home is used while the guarantee so you’re able to safe the mortgage. In terms of signature loans, they are often unsecured, but shielded choices are available. Secured finance need guarantee particularly a car, discounts accounts, or any other assets.

Amount borrowed, period and you will interest rate

Home reount (age.g. six minutes monthly money otherwise a limit regarding S$30,000) and you can quicker tenure, however, mortgage loans naturally allow highest financing wide variety to pay for assets costs and cover lengthened payment periods. Signature loans provide much more liberty inside element and generally are varying when it comes to each other count and you can tenure, with respect to the bank therefore the borrower’s creditworthiness.

With regards to interest levels, there are some signature loans such as for example UOB, Practical Chartered CashOne, GXS FlexiLoan which offer dramatically reduced rates of interest (below step three% since this new pricing authored to the ) than simply very recovery finance and you can lenders.

Omitted costs

Since temporarily shared from the above dining table, extremely domestic recovery finance can not be useful to find moveable furniture otherwise equipment including couches, beds, refrigerators, or decorative points such as curtains and you will light fixtures. Similarly, mortgage brokers have exceptions plus don’t security any blog post-pick costs eg home improvements, fixes, otherwise interior decorating. With unsecured loans, you will find usually no specific exclusions with regards to incorporate, but the bigger characteristics does not include the great benefits of good specialised mortgage like lower rates of interest getting particular aim.

Disbursement procedure

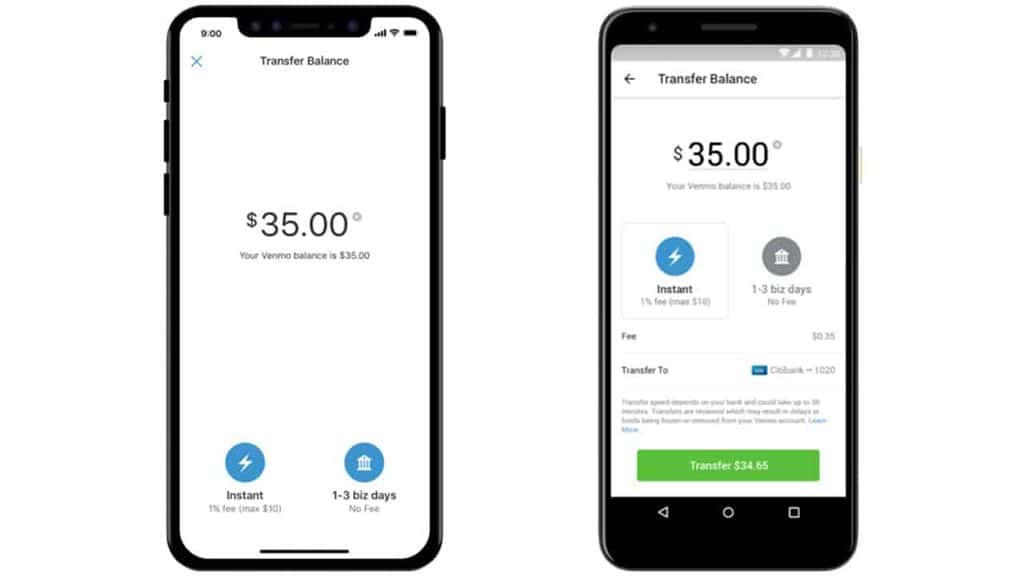

For house restoration finance, loans are usually paid down right to the fresh new builders, however for home loans, the mortgage matter is disbursed with the property provider or designer. The newest disbursement process having a consumer loan is different from one another household renovation fund and you can mortgage brokers since the debtor gets the funds physically features the latest discretion to use all of them as required.

Which Mortgage Is perfect for My personal Home improvements?

Choosing the most appropriate version of mortgage for the home’s repair most utilizes several affairs instance interest rates, aim of credit, financial ability to pay the borrowed funds when you look at the a certain amount of day, and many other things factors. Just like the all borrower’s monetary requires differ, ergo there isn’t any distinct address (that meets anyone) to that particular.

To determine which is much better, you can also reference the post here, and that features a few of the tips to notice. The following is online payday loans Idaho our short bullet-upwards of the finest 5 loans that you may think to possess your home home improvements.

*Projected research collated above is based on the fresh particular financing package providers’ (DBS, OCBC, HSBC, CIMB) other sites and you may ‘s the reason 3M Combined SORA cost, last current here towards the .

Interested in unsecured loan costs as little as 2.88%?

Go to MoneySmart’s personal bank loan calculator and you can analysis equipment to figure every thing away. All you need to perform try type in your information and you will desired loan amount and tenure, and we will automatically find the best alternatives for your.