We have found a good example from our very own habit of just how good WVOE program works, as well as how flexible and creative lenders regarding low-QM room can be:

You to lady concerned us immediately following being denied by a different lender. She was lower than package to buy an effective condominium, and her closure due date is actually handling. We watched instantly that she had numerous activities, starting with their unique functions background: Loan providers normally require applicants to possess did no less than a couple of years with similar boss.

However, our buyer got recently gotten a disease analysis, and that pushed her when deciding to take 10 months out-of having treatment. She are eventually medically eliminated to go back to operate fourteen months ahead of their own application. She returned to work with an equivalent profession. However, she couldn’t fulfill the regular 24-week functions records specifications.

She was also trying pick a non-warrantable condominium when you look at the a job where the HOA had produced an excellent build defect lawsuit contrary to the designer. Condos which have pending structure problem claims become more tough to fund since they’re riskier to have loan providers, and do not qualify for antique financial resource regarding being qualified lenders. ( View here for additional info on providing home financing towards properties which have pending construction problem states .)

As well as regarding and additionally line, the consumer got a high credit score away from 766

The brand new condo development has also been 66% renting, rather than owner-residents, which had been a separate grounds making the assets hard to funds.

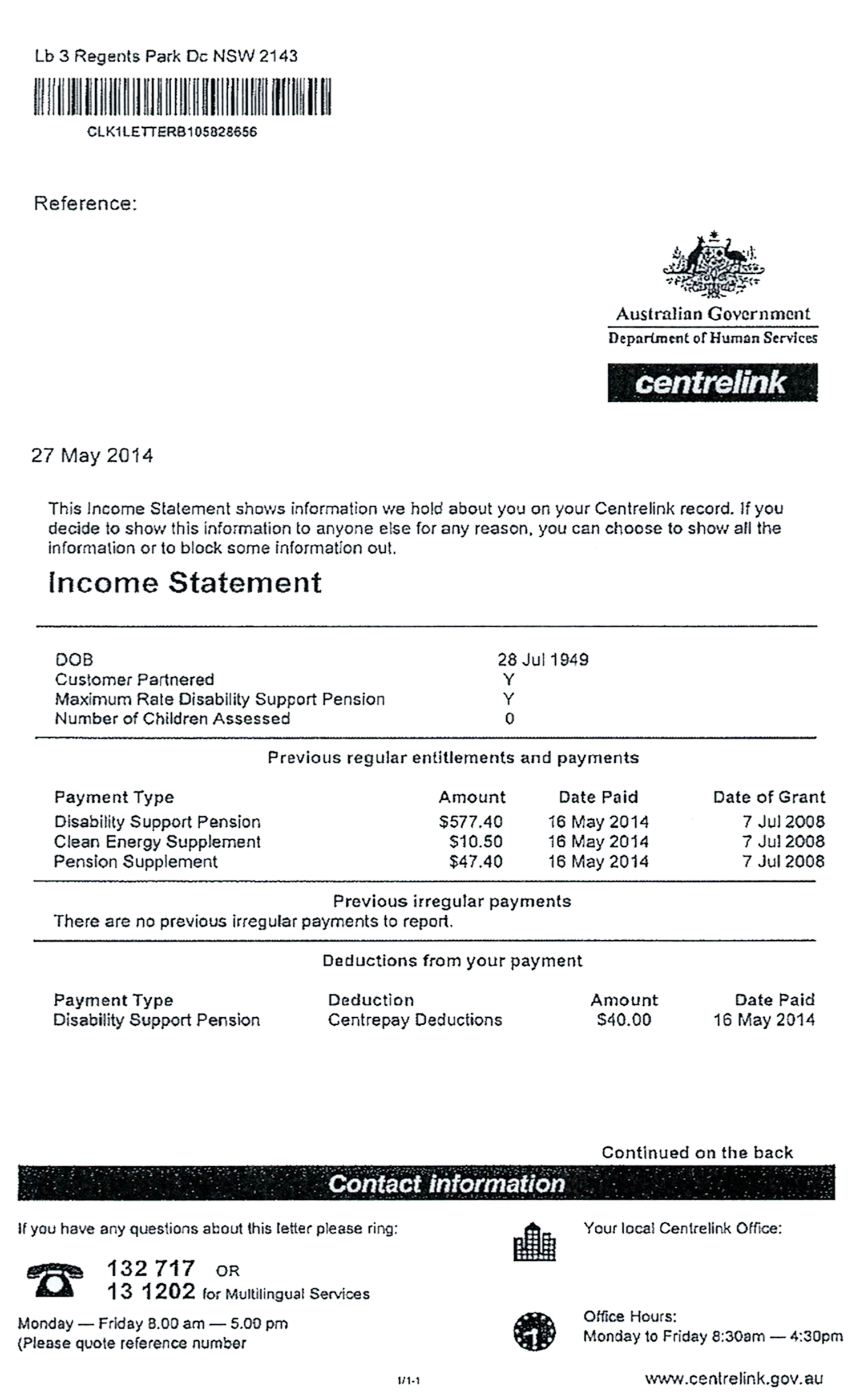

Furthermore, by the lengthy period of jobless, their own tax statements don’t reveal enough earnings along side early in the day one or two years so you can qualify for home financing. We understood we had a need to use an excellent WVOE so that the tax statements wouldn’t be difficulty.

Applying the Four Cs to discover the mortgage recognized

So we know the work are cut out for people: Our customer got difficulties with several of the Five Cs one to lenders check to evaluate loan applications :

- Reputation

- Skill

- Capital

- Conditions

- Guarantee

I know reputation would not be problems. Market conditions was indeed acceptable. However, due to her shorter money along side past 24 months therefore the period of jobless, we had to overcome a hurdle whether it came to indicating her capability to safeguards her home loan repayments afterwards.

She wasn’t standing on a huge pile of possessions, so she was not solid throughout the investment line. And because of highest tenant occupancy in addition to pending framework defect legal actions, there were severe issues with the security on this loan.

I know away from a lender who likely be versatile and you may manage to look at the entirety of our consumer’s situation. We accomplished the applying towards the visitors, while the client including connected an in depth letter detailing the reason to own their unique get down employment.

And additionally outlining their unique ages of jobless, our very own buyer has also been in a position to demonstrate that she had a good JD knowledge together with more than fifteen years away from gainful work sense as the a home planning lawyer along with nice generating capacity to cover their mortgage payments.

She as well as got seemingly nothing loans, very their credit application proportion are solid during the thirty-six%. Every one of these assisted buttress their unique ability to build her repayments.

Because the we were speaking about a non-bank bank in the low-QM home loan business, they were not beholden so you can Fannie and Freddie’s bureaucratic standards. They are able to admit the grade of new debtor and supplied numerous conditions to their common underwriting conditions.

The financial institution no credit check payday loans St Stephens acknowledged their particular application to have 80% LTV. And then we got a very clear-to-close in only fourteen business days better in advance of their closure deadline.

1xbahis Güncel Adres » 1x Bet Mobil Casino

1xbahis Güncel Adres » 1x Bet Mobil Casino Türkçe Casino Sitesi

Türkçe Casino Sitesi