Previous accounts from the monetary force highly recommend much more homeowners try bringing aside bridging loans so that a buy can be go ahead ahead of they provides offered its established assets. A diminished likewise have during the desired-immediately after towns and cities has made certain consumers unwilling to eliminate a house which they want.When you find yourself offering your home and buying a different sort of, you are going to always make an effort to complete the several purchases right back-to-back. You can then use the income out of your profit to pay for your purchase, and there is generally a sequence out-of interdependent purchases in which for each consumer, except the only towards the bottom of your own strings, hinges on selling their unique assets in advance of capable go ahead.Providing a loan, that helps you link the pit anywhere between getting your new domestic and later completing the newest profit of your own old you to definitely, normally enable you to secure you buy no matter what any waits from inside the the newest chain if you don’t if it collapses. However you will individual two properties for a time and there is actually threats which you must thought and may check with your own solicitor,’ states Lyndsey Dull, an authorized Conveyancer about Home cluster having Bailey Smailes.

If you plan buying a unique assets ahead of promoting your existing domestic, this could features tax effects. There are certain reliefs, for funding development tax and genetics income tax intentions, and that affect the dominating individual house. Buying a couple of services changes just how such reliefs apply and you will discuss the ramifications with your elite group advisors.Furthermore, it p responsibility land tax on your own purchase. Because you will very own multiple possessions, you are going to need to shell out stamp obligation land tax at a beneficial higher level. There was supply for a refund for people who promote your dated home contained in this 3 years. Yet not, just be sure to definitely see the conditions and factor this into your agreements.

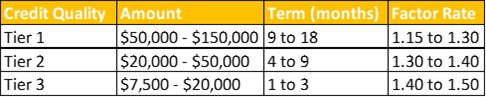

Whilst operates by themselves of revenue, it may be a substitute for agreeing a put-off end or being forced to pick a unique client in case your chain collapses. It can also be appropriate if you need to flow swiftly, instance when selecting during the public auction. At the same time, connecting money are readily available for certain kinds of assets whenever a normal financial is not.Although not, there are also drawbacks. In the end, whereas what you can do to track down a home loan all hangs abreast of your own money, to qualify for a connecting loan you must satisfy a loan provider you have sufficient property, such which have sufficient security on your current possessions.

If it happens, ask yourself how you will repay the borrowed funds

There are 2 brand of bridging loan: closed’ in which you will have a predetermined avoid go out, such as for instance if you have exchanged deals on your own deals and you can want finance so you’re able to wave your more than if you don’t located the completion funds; or open’ with no fixed stop day since you have no confidence more exactly after you can pay it off, as the lender will usually predict fees within one season.

You should discuss your role along with your conveyancer. Like, if you intend to make use of the fresh new arises from the fresh new deals of your property, you will need to just remember that , if you don’t exchange agreements your potential people could changes their heads. After you’ve exchanged deals, your own customers is actually lawfully bound accomplish to your assented completion go out. In spite of this, new plan is not entirely risk-free and you will, if you decide to just do it having a connecting mortgage, we possibly may strongly recommend more ways of mitigating chance.

It’s also possible to be interested in alternatives with regards to the state, particularly a delayed otherwise conditional completion go out, borrowing regarding family unit members, remortgaging your existing assets, equity launch, promoting expenditures, or playing with element of your pension.Whenever you are to purchase out of a creator, they may be also ready to take on your existing assets inside area change.What’s right for you all depends up on your own activities. Since your solicitor, its all of our consideration to be sure you are Security Widefield loans aware the choices and you can risks inside.

A bridging fund lender will always simply take a fee over your own existing property as protection. If you’re unable to pay back the borrowed funds, it indicates you could potentially get rid of your residence. Having a very good cost package is vital.Bridging fund comes to additional products therefore the judge records was some different from a normal financial. For many who currently have a home loan on your own current possessions, this new bridging loan bank will take the second charges and that the lending company will need certainly to say yes to.You should use a great conveyancing solicitor with experience with this region. This can make certain achievement of one’s required formalities immediately and you will maintain one of many great things about bridging fund: speed.

I’ve experience with all aspects out-of property conveyancing, as well as connecting finance. A connecting loan might not be right for men, and we will constantly leave you independent advice for the dangers involved. Anything you pick, we shall help keep their exchange on course even though one thing dont wade completely to plan.For further information on selling or buying your home, please contact Lyndsey Incredibly dull throughout the Residential property people towards the 01484 435543 otherwise current email address Bailey Smailes features workplaces in the Huddersfield and you may Holmfirth, West Yorkshire.

First, connecting finance usually are higher priced than just conventional mortgages with higher interest levels and additional set-upwards charge

This article is having standard suggestions just and does not compensate court otherwise professional advice. Please be aware that the law have changed since publication of post.