A low credit history doesn’t stop you from delivering good Pros Situations Virtual assistant loan. There are various bank software that will help you score a mortgage.

Training that exist a mortgage that have reduced credit the most curing what things to tune in to since an excellent client starts buying their very first home. Lender conditions and you may loan application conditions are continuously changing. A loan provider happy to help you and you can help in which you are to get you regarding a reduced credit rating to the acquisition of your own basic residence is eg a gift when it comes to the home-to find trip. Products that might be noticed for every types of loan become credit rating, assets, payment history, and many more lender-based qualifications.

Mortgages are going to be qualified for which have a loan provider thinking about all of your a lot more than certificates and other unlisted items. The crucial thing when a debtor trying to make use of the Virtual assistant mortgage that have a certificate away from qualification knows many different quantities of approval and needs for them to make it through the borrowed funds process. Let us enter into a number of the method of overcoming low borrowing from the bank results therefore the tactics you could test nevertheless try to get certified.

Just how do Credit scores Connect with Va Financing Recognition?

Credit scores change the Va financing approval techniques when it is one to area of the puzzle lenders see to analyze your full credit history and you will finances. Your credit rating lies in the prior credit history that have loan repayments, was indeed it produced on time and many more circumstances? Just how much is it possible you typically financing, precisely what do you may have on financing currently, and therefore are you paying it straight back are a couple of other items which can be examined whenever a credit score is invented. The credit get full having good Va financing try a good checkbox since the Va qualification criteria lack at least criteria. Rather, the Va makes that around the lender to choose the individual minimum credit scores. And here, when purchasing, home buyers will want to comprehend the requirements of the financial. Being clear concerning your situation will be very beneficial because the certificates to own loan providers tend to transform.

What makes Virtual assistant Financing Conditions To have Credit ratings Less limiting?

The theory is that, Va Financing conditions are less strict since Va financing was a federal government-backed financing which makes them much safer to your financial, but they dont reason a complete number in case your customer defaults otherwise will get foreclosed to your. FHA money is similar. The us government service backing the borrowed funds that have insufficient lowest borrowing from the bank get requisite of the Virtual assistant is the one step-in the newest lenders’ process, but the financial will have what’s named overlays, which happen to be statutes that then establish new lender’s standards hence occurs when you generally pay attention to a loan provider let you know that it keeps conditions getting credit scores and total loan application results one to can help you move ahead in your brand new pick.

What’s the Minimal Credit score Getting A Virtual assistant mortgage?

The newest Virtual assistant doesn’t always have the very least rating, but it is important to understand that this new Virtual assistant isnt brand new entity that’s investment the loan; new Virtual assistant financing system allows experts or other Virtual assistant mortgage-qualified consumers to seem more desirable to loan providers as the Va have a tendency to partly right back (insure) the loan. This kind of insurance is a means of providing the financial a decreased susceptability, hence boosts the elegance to own a lender to aid the brand new consumer that all the way down credit scores will a time in which they can be considered to purchase property.

Less than perfect credit home loan alternatives

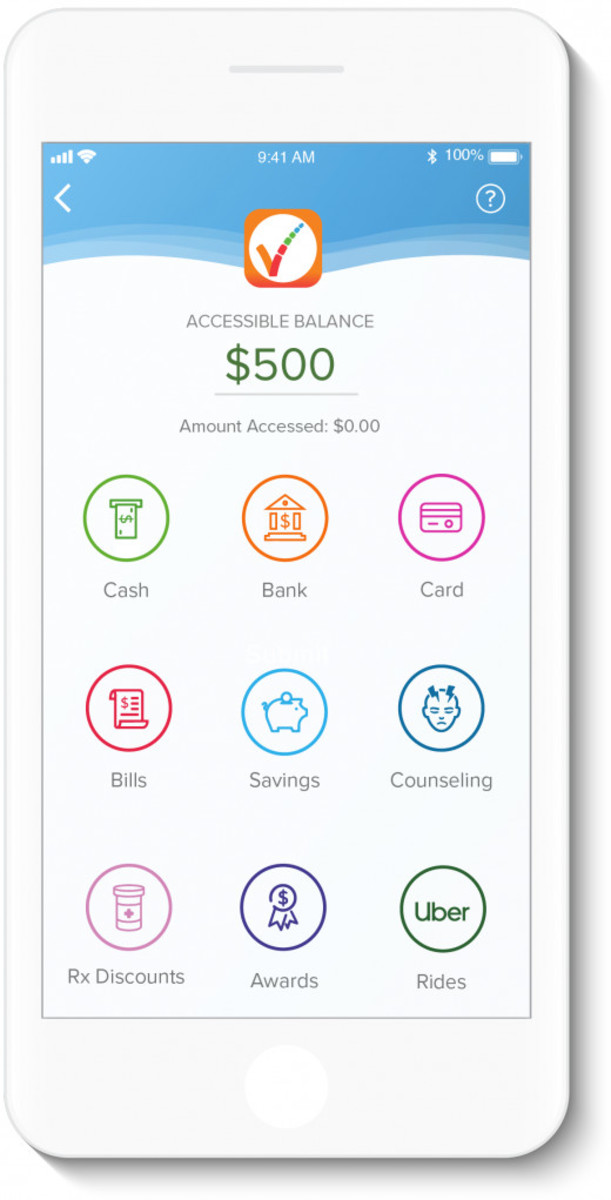

Poor credit isnt a program-stopper! Choices are online according to what your bank produces happen. Consider, as you meet the requirements, youre qualifying having some that loan you could create monthly obligations for the. This can trigger problems in large-costs components since you might not be able to qualify for high-costs components that have https://paydayloancolorado.net/chacra/ lower fico scores and you may non good application symptoms. Average house revenues will generally vary from town so you can urban area, very keep this into the idea in terms of your home-to shop for processes. It can help for folks who constantly start at the beginning of the full writeup on your own borrowing. Check for info available to choose from observe the way to be intentional throughout the getting the score right up. You may think reaching out to a lender to acquire advice on all you have to perform second, while the particular loan providers have advisors they are going to highly recommend. There are also far more imaginative indicates, like providing a co-signer. Having a beneficial co-signer, you are able to somebody else’s borrowing to assist you when you look at the qualifying to possess best words. Go ahead and come to into ADPI blogspot and watch a whole lot more info on one to! A good co-borrower is additionally a great option whenever you are purchasing having somebody or mate.

Can you Get An excellent Va Mortgage Which have a great 580 Credit score?

Delivering a good Va loan to suit your no. 1 household that have an excellent 580 credit history can be done, however, there may be a lot more terminology than just in case the borrowing from the bank are above 800! A less than perfect credit get isn’t impossible to possess loan providers to work with. Not everyone has actually advanced level credit ratings; first-go out home buyer inhabitants to people that have bought in advance of all of the have different economic facts.This is certainly on account of multiple things, not only as they didn’t shell out punctually or have been in a huge amount of obligations. An area which is high to a target to own Virtual assistant money are users who will be during the early amounts of their work. Some army people subscribe right of senior school and also have never actually had a bill within identity. It is not a tv series stopper, it is a bit of a hurdle to acquire over regarding qualifying having lenders that certain standards that have to be satisfied to ensure might pay on time as well as don’t get you to the a loan you to are unrealistic to expend. Thus with that said, credit ratings commonly a mandatory need for this new Virtual assistant, anytime the financial institution observes you have got a minimal credit history, they’re going to evaluate one along with your full finances and could make you provide details and or correspond with your regarding the schedule to obtain the score upwards so you’re able to diving in the brand new home!

Select some tips below in the first place to boost their borrowing rating. Plus, make sure to shop constantly which have lenders and you can bank conditions and you can acceptance conditions alter will!

1xbahis Güncel Adres » 1x Bet Mobil Casino

1xbahis Güncel Adres » 1x Bet Mobil Casino