For most earliest-go out home buyers that are carrying financial obligation, saving right up 20% to have a deposit isn’t reasonable which can be Ok. Just be aware putting off below 20% means you can easily wanted financial insurance rates and as a result, have a tendency to bear even more will cost you. Paying the mortgage insurance costs are likely a far greater solution than just waiting normally 14 many years to settle the personal debt and you can go into the market, especially today just like the will cost you regarding homes in the Canada always skyrocket. For people who prepare in advance for a lot more costs you get happen getting getting down below 20%, there is absolutely no good reason why you simply can’t put property in the finances.

What is the Most recent Interest In your Personal debt?

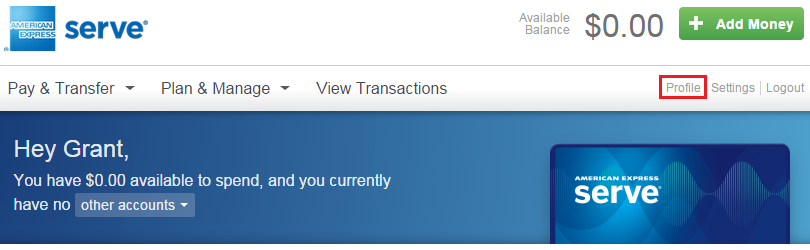

:max_bytes(150000):strip_icc()/Screenshot6-75a9b522251943018beb91a340fbfe82.png)

Beginner debts keeps all the way down interest levels than other personal debt you’d bear out of handmade cards otherwise a keen unsecured personal line of credit. No matter, expertise exactly what your newest rate of interest try will help you to influence how much time it will probably take you to spend it off and you will exactly what kind of desire you can easily sustain because you functions into one purpose.

How much cash Current Loans Do you have?

You can nevertheless be recognized getting a home loan in financial trouble, yet not all expenses are addressed just as. Simply take a good, close look at your present financial obligation along the boarde with an obligations payment decide to guarantee you may be fulfilling all minimal payment criteria and securing your credit rating meanwhile. Imagine financial obligation stacking or debt consolidation reduction alternatives when you’re concerned about and also make so many repayments to different provide that have different rates. Having your current personal debt in balance is amongst the very first confident things to do into seeking homeownership.

Precisely what does Your credit score Seem like?

For many of us, studying your credit rating and you can keeping track of they continuously is a big package. After you’ve made that leap, you might functions for the improving they (if required). In general, the fresh new smaller financial obligation you’ve got, the better your credit score could well be. payday loans Tall Timber However, that does not mean you simply can’t hold obligations anyway in the event that we want to submit an application for home financing. The point of your credit score is to track the method that you control your current personal debt, whether it is $5,000 otherwise $fifty,000mit to making regular payments to your your debt and you will get a hold of an improve on the credit rating that’ll enhance your opportunities to be approved getting financing.

Making normal costs as promised is a must to possess keeping a great credit rating therefore you should never sacrifice people minimum money into the sake from rescuing to own a deposit once the you’ll be able to risk the probability off acceptance for a loan in the act. In the event that having a home is something you would want to pursue, it will be best if you start record your purchasing and you can figuring the debt-to-money ratio to make sure you find the money for save yourself to have a down-payment to make the minimum student personal debt repayments in place of going family poor in the process. Do you have a subscription you could real time rather than? Something that you overspend towards the continuously that might be reined into the? Getting a lengthy close look at the in which your money goes often help you focus on the purchasing and rescuing to flow towards your brand new needs instead of wasting profit other areas.

You might nevertheless be eligible for home financing despite your own beginner financial obligation. The main will be on time with your payments and you may guaranteeing you have got enough income so you can counterbalance your debt and you will help their investing in other parts such as for instance paying for lease, utilities, market etcetera. Loan providers seek in control borrowers. They understand that all some one hold debt in order much time as it’s becoming handled sensibly and you can effortlessly, it should not apply at your ability to help you acquire.