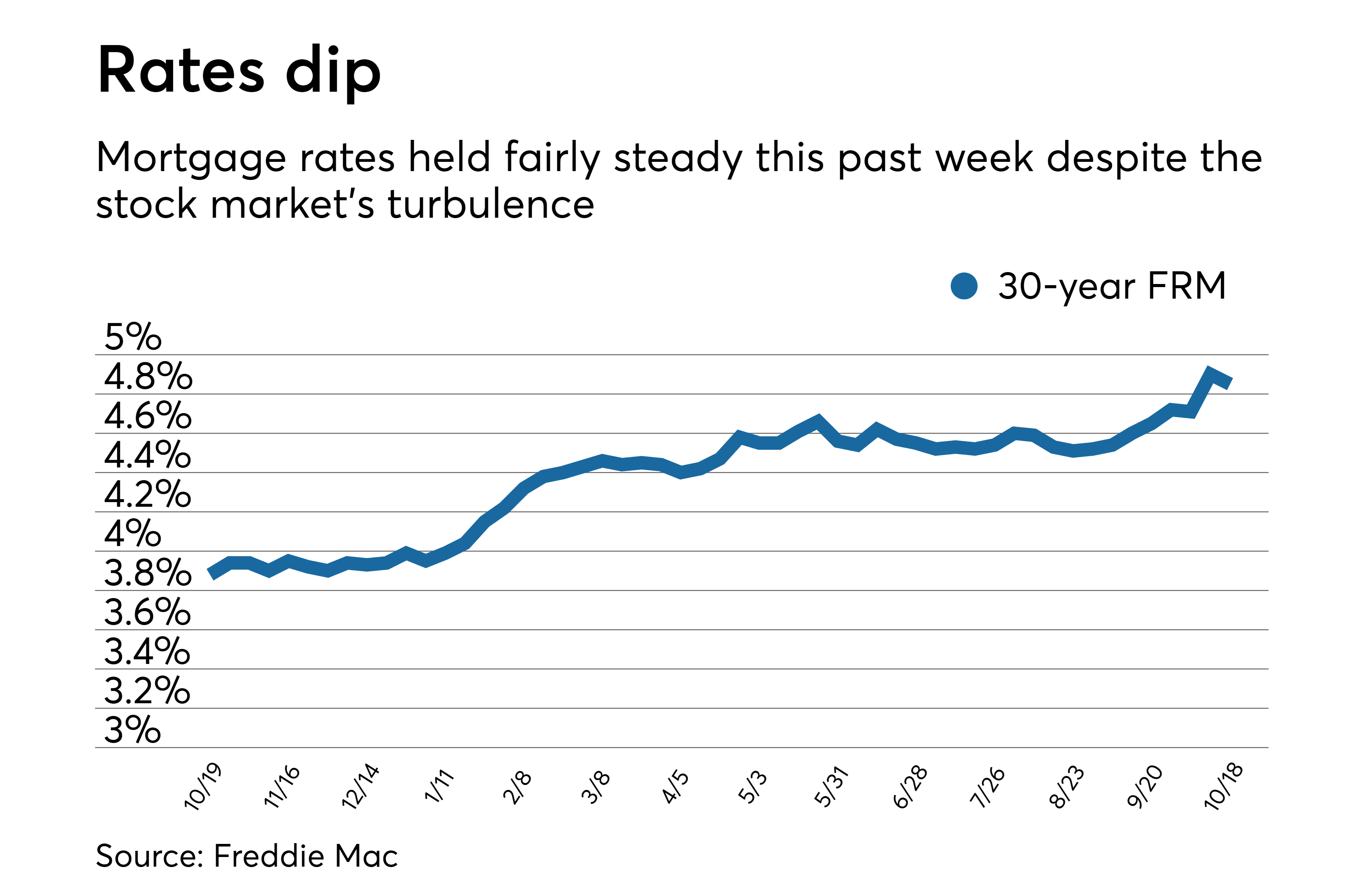

You’ll be able to have to account fully for personal financial insurance rates (PMI). Home owners will have to pay PMI whenever they you should never create in the minimum an effective 20% deposit on the family. With all of this type of possible will cost you, its helpful to explore all of our Ohio financial calculator. All of our product will help break down the costs to help you see just what their monthly mortgage repayments will appear as with other situations. If you wish to re-finance a preexisting mortgage, all of our Ohio home loan calculator may also help you determine your monthly fee — and https://cashadvanceamerica.net/payday-loans-mi/ you may here are a few the listing of a knowledgeable refinance lenders to locate one to techniques become.

Before you buy property from inside the Kansas, it is very important definitely get money in check. You need:

- Good credit

- A low loans-to-money ratio

- A constant revenue stream

- A downpayment saved

- More cash beyond the down payment to pay for ongoing restoration, repairs, or any other emergencies

There are also specific certain circumstances you should be aware off when selecting a home within the Kansas. The state has actually four collection of pure countries: the newest Lake Flatlands, Till Plains, Unglaciated Appalachian Plateau, Glaciated Appalachian Plateau, and Lexington Basic. Due to the proximity so you can biggest canals being about Midwest, Kansas try subject to flood and you may tornadoes.

Ohio in addition to comes with five out of Realtor’s top twenty-five casing : Toledo (No. 10), Columbus (Zero. 14), Cincinnati (Zero. 19), and you may Dayton (Zero. 23). This type of avenues try ranked of the sales and rates growth.

Methods for earliest-day homebuyers when you look at the Kansas

Here are a few essential tips for basic-big date home buyers to enable them to navigate the process. There are a few applications designed for earliest-time home buyers from Kansas Houses Fund Institution (OHFA). OHFA even offers traditional mortgage loans designed specifically for home buyers which have low- and you can modest-earnings.

OHFA lets home buyers to choose either a two.5% or 5% advance payment of your own house’s price. Direction can be applied into the down money, settlement costs, or any other pre-closing costs. Which assistance is forgiven shortly after 7 many years.

So you’re able to be eligible for the new OHFA Your decision! Advance payment Recommendations system, homebuyers will require the absolute minimum credit history out of 640, meet earnings and buy rates limitations, and see obligations-to-earnings rates for the loan form of.

- FHA financing are mortgage loans right back because of the Government Houses Power and you will want an effective step 3.5% down payment.

- Virtual assistant loans is actually to own army solution people and want an effective 0% down-payment.

- USDA financing try government-supported funds to own qualified properties and want good 0% deposit.

- Fannie mae and you can Freddie Mac is traditional loans that want a good 3% downpayment.

Try for a house-to buy finances

Once you’ve and have shopped around with different lenders, you will need to go after property-to acquire budget. Of numerous it is recommended that monthly house fee (including additional will cost you) become just about 30% of monthly earnings.

It is very important to maintain good credit, so try not to apply for one playing cards or any other funds right in advance of your residence look. Credit file concerns have a tendency to feeling your credit score. You should also can pay for stored having settlement costs. Almost every other charge such financing costs, checks, and you can control costs are not always protected by the borrowed funds.

Have inquiries?

Home owners can certainly be section of a residents association (HOA) and possess to blow a monthly HOA percentage near the top of their home loan repayments. HOA charges constantly defense the maintenance off popular elements, and sometimes include properties instance scrap pickup. To get in these types of extra costs into the significantly more than mortgage calculator to have Ohio, follow on “A lot more enters” (less than “Financial sort of”).

1xbahis Güncel Adres » 1x Bet Mobil Casino

1xbahis Güncel Adres » 1x Bet Mobil Casino