Refinancing shortly after forbearance

The length of time you might be necessary to hold off is dependent upon the fresh items of one’s financial hardship and if you leftover up with people planned repayments utilized in their forbearance plan.

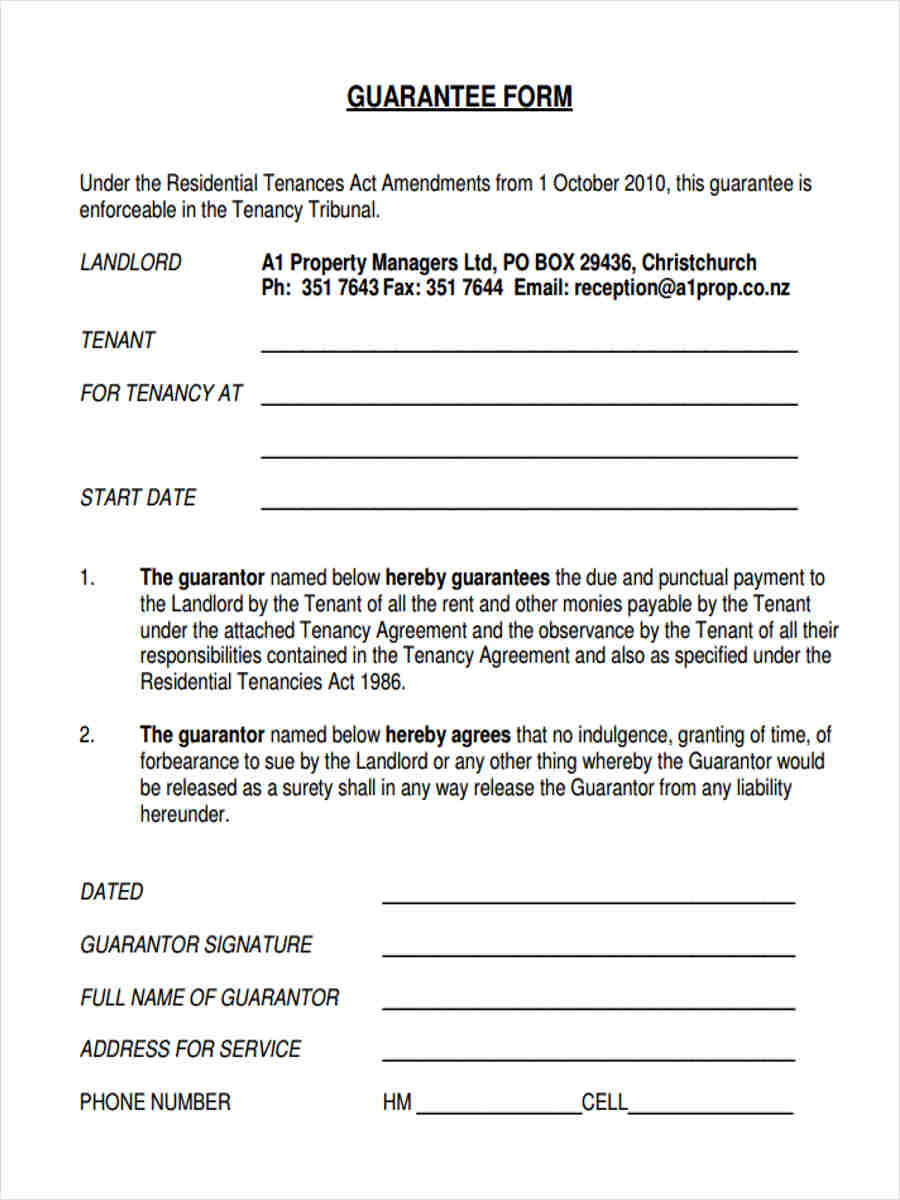

For people who registered forbearance due to COVID-19, you generally need not wait after all, as long as you’ve made your current three to six repayments on time. The newest desk lower than shows the main points:

But not, if for example the issues was basically not related so you’re able to COVID, you could be stuck looking forward to around 12 months before you might re-finance.

Refinancing shortly after loan mod

If you have come from loan mod process along with your bank, you are able to typically have to attend several in order to 2 yrs adopting the mortgage loan modification so you can qualify for an effective re-finance. not, in the event your loan modification is once you exited a good COVID-19 forbearance program, you won’t need to waiting, providing you generated the very last half dozen so you can a dozen repayments of the mortgage loan modification promptly.

Alternatives to refinancing with late repayments

If you cannot re-finance your financial, you really have several possibilities to fall back to the. Their precise action to take hinges on your financial type of, exactly how early in the day-owed youre as well as your lender’s choices. While some of them possibilities allows you to stay static in the family, other people dont.

Check with your lender right away to talk about the options and next measures. Good HUD-recognized houses counselor also can render after that pointers.

Fees package

With a cost bundle, their lender will give you a structured contract to fulfill the later otherwise outstanding mortgage repayments. This can include expenses the main earlier in the day-due count with your monthly premiums until the financing was current. Their bank ount before the end of one’s loan term.

Typing a repayment plan makes you stay static in our home and you will provide the loan current if you cannot refinance new outstanding mortgage.

Mortgage forbearance

If you’re experience pecuniary hardship – death of work, infection, sheer crisis or any other events – you can qualify for financial forbearance. That have home financing forbearance, your own bank commonly

Observe that forbearance will not eliminate the paused otherwise faster costs. Focus with the financing continues to accrue, along with your lender can give options for recouping the lower otherwise paused numbers.

Home loan amendment

A home loan amendment reduces your payment by switching the newest terms of your own loan. Such as, your bank can get personalize the home loan because of the stretching the mortgage label, decreasing the rate of interest or decreasing the principal balance.

It’s not hard to mistake loan mod with refinancing, however the several aren’t the same. That have a loan modification, you’ll be able to still have a similar home loan and you will financial however with changed terminology. As well, you won’t shell out fees otherwise closing costs to change your mortgage. Likewise, for people who refinance, you should have an alternate financing that pays the present mortgage equilibrium – though you will also have to pay re-finance closing costs.

Short sale

In case your mortgage is actually underwater – after you owe more about your loan than the house is really worth – you might imagine an initial business. A short business makes you personal loans for bad credit Tennessee promote your home for less than simply its worth, plus financial welcomes the fresh proceeds of the sale because the installment of your mortgage, will as opposed to you being required to come up with the complete financing amount. When you’re a preliminary sale will adversely impression the borrowing from the bank, the effects could be smaller harmful than you would select which have a foreclosure in your list, and you could also possess some of one’s personal debt forgiven.